This New Year it is also a great time to start making solid financial resolutions that can help get you closer to your money goals, whether it’s increasing your retirement savings or setting enough money aside for a down payment on a house.

When does the underarm stop for Kiwis?

Currently in Australia there is more than $17 billion in unclaimed superannuation, which is not an insignificant sum of money, and we anticipate that a large proportion of these funds belongs to Kiwis.

Booster boosts fund options, tweaks settings

The balanced fund joins its Asset Class growth and conservative siblings, which are ultimately managed by US factor-based investment house Dimensional Fund Advisors.

House prices out of step

House prices in New Zealand versus the average Kiwi income have more than doubled since 1980.If you thought house prices were hot, you were right, but this figure shows home ownership is becoming a more and more distant dream for the average New Zealander, unless we see market slow-down or correction

Like Romans, fall on our sword and raise retirement age

The issue of ageing populations and funding retirement schemes is not a modern one - the Romans faced the same political and fiscal problems 2000 years ago.

Get Sorted: KiwiSaver deadline is end of June

As published in NZ Herald, Hawke's Bay Today.

Deadlines can bring out our best work. Why is that? There's something about being under the pump that makes us rise to the occasion and simply get it done.

We just find a way somehow.

This time of year - before June runs out - is the deadline to get the annual $521 from the government into our KiwiSaver accounts. It would be great if we could all look at our situations - and consider those around us who may be missing out on the practically free money. If they're over 18, we might even help them top up their accounts so they get the most they can.

So many of us get the full amount that it's a shame for anyone to miss out what's due to them. And over the life of someone's experience in KiwiSaver, we calculated the government payments could be worth as much as $36,000. Now there's a chunk of change for you.

How to get your government money this year

The trick is to make sure that we've contributed at least $1,043 into our KiwiSaver account over the past year. (If you joined part-way through or turned 18 during the year, you'll be eligible for some portion of the $521, based on when you did. Everyone else can get the full five hundy.)

If you're an employee and earned at least $34,762 and contributed the minimum of 3%, you'll automatically get it. If you're self-employed and have already put in more than $1,043, you will too. No worries.

But if you haven't yet reached $1,043 this year, now's the time. Before the end of June, you can top up your contributions to that amount so you get the government boost. Simply contact your scheme provider and make it happen. Just in time to make the deadline.

And typically by the middle of August, we'll all see that extra $521 hit our accounts. Sweet.

How to make sure you'll get it next year

If you miss this deadline and don't manage to put in the full amount, you'll still get 50 cents for every dollar you did put in. That's worth something. But let's look ahead to next year.

The KiwiSaver year runs from July to June, so this coming July is a chance to reset our finances to make sure we're on track to for next time. If we set things up right, we can easily be on the money in June 2018.

Over a year, putting in $1,043 works out to slightly more than $20 per week, which is far more manageable than having to come up with the whole amount just before the deadline.

Automatic payments directly into our KiwiSaver accounts are our best friends here, allowing us to forget all about it and let it run on autopilot. Contact your provider to make this happen.

Out of sight, out of mind. And when next year's deadline rolls around, we'll all be ready.

- Source: New Zealand Herald

Small and regular will yield results

If you are 5 or 45 years away from retirement, joining KiwiSaver is a ‘no brainer’ option.

There is the free $1,000 kick-start from the Government, which gets your KiwiSaver savings and compounding returns started immediately; member tax credits for contributing members aged between 18 and 65 years (currently up to a maximum of $521 per member per annum); and if you are over 18 your employer will match your contributions (the minimum now being 3 percent).

KiwiSaver is locked in until 65 meaning unless you use it to buy your first home or suffer hardship. This means that if you continue to contribute to it, your KiwiSaver Scheme Fund will be a nice little nest egg to supplement your NZ Superannuation when you decide to retire.

Other benefits are that you can easily transfer between KiwiSaver providers if you are not satisfied with your current KiwiSaver experience (whether for performance, reporting, change of ownership or other reasons); you can easily switch between funds staying with your same provider, eg from growth to balanced; and if you have lived overseas and have acquired a foreign pension or superannuation fund, you can transfer it into your KiwiSaver Scheme Fund (however, not all countries or KiwiSaver providers will allow transfers).

To simply depict how effective it is to join KiwiSaver:

If you are 20, just finished your tertiary education and earning $30,000, your annual KiwiSaver contribution (at the current minimum rate), will be $900, with your employer also contributing $900.

This will mean by the end of year 1, you will have a KiwiSaver balance of $2,800 without taking into account any growth (or fees). Your 45 years of KiwiSaver contributions, allowing for a 2% increase in salary each year, and an assumed net yield from your investment of 5% per annum, will give you $508,820 by age 65. It is important to note that these calculations do not take into account inflation - $500,000 in 45 years will not have the same spending power as $500,000 does now.

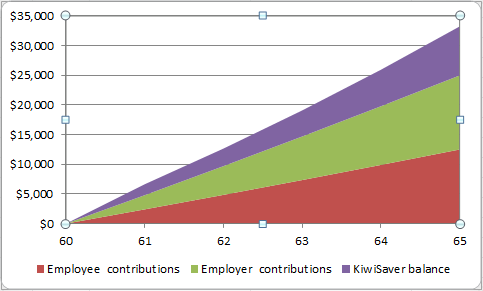

20 Years and above age with 30 K annual earnings

If you are 60, on a $80,000 salary, with 5 years left until NZ Superannuation kicks in, your annual KiwiSaver contribution (at the current minimum rate), will be $2,400, with your employer also contributing $2,400 each year. If we take into account your 5 years of KiwiSaver contributions, again allowing for 2% salary increases and a 5% net yield then you will have $33,229 at retirement age. Or you could up your contributions to the maximum rate of 8 percent with your employer’s still at 3 percent, and your KiwiSaver balance at 65 would be $57,337. Again, inflation is not taken into account in these calculations.

60 years and above with 80 K earnings

It sounds too easy, doesn’t it?

The key is that small and regular contributions make savings happen, and as they grow, the gains you make are re-invested in your KiwiSaver Scheme Fund and have a compounding effect, meaning your KiwiSaver investment gets bigger and bigger. Obviously, the rate of growth of your KiwiSaver investment depends largely on the type of fund you’re invested in which is usually decided by a couple of other factors like your appetite for risk, age and number of years until retirement, which will dictate the type of fund you invest in and the proportion of volatility it is exposed to. For example, a growth fund always has a greater proportion of equities compared to a conservative fund, which will be invested in more fixed interest and less equities. Therefore the growth rate of your KiwiSaver Scheme Fund will depend on how the fund is invested, the fees and if you’re entitled to tax member tax credits.

Meaning, it is never too late to join KiwiSaver and the sooner you start, the more you have to gain when you do decide to retire.

- Source: Outside the Flags, Dimensional Fund Advisers

Stewart Group secures access to US fund

Nick Stewart, Prof Ken French (Director, Dimensional) and Don Stewart

In a coup for Hawke's Bay, wealth and risk management specialist Stewart Group is now an asset consultant for Fidelity Life's KiwiSaver schemes that include Texas-based Dimensional Funds Advisors' (DFA) funds.

Dimensional is the eighth-largest fund adviser in the United States.

"The Asset Class Conservative Kiwi Fund and Asset Class Growth Kiwi Fund Asset with Dimensional's strategies are unique, giving everyday investors the opportunity to have to engineer from the best minds in modern finance within their own New Zealand-based investment," company director Nicholas Stewart said.

Once KiwiSaver members join the Fidelity KiwiSaver Scheme they can tailor their investment profile by blending holdings across up to four funds.

The biggest drawcard is expected to be the option of moving to the Asset Class Conservative Kiwi Fund and/or the Asset Class Growth Kiwi Fund having their KiwiSaver contributions invested mainly in DFA (Australia) funds.

"Dimensional funds are generally not accessible to mum and dad investors because the minimum investment level is too high and they are not open to the public," Stewart said.

"There are only a small number of DFA-accredited New Zealand financial advisers offering Dimensional funds - and none in the KiwiSaver market."

The Asset Class Funds will not charge performance fees.

"We believe fund performance is a result of market performance, not manager stock selection or market timing."

Stewart said KiwiSaver funds were closing because providers were seeking increased economies of scale "to make more money".

"We came about this not to make a dollar, we came about this because we wanted to do the best for our clients. And that's rather unique."

Stewart met DFA director and Ivy League professor Ken French 11 years ago while Stewart was a 25-year-old graduate, on holiday from his job at a merchant bank.

French's academic research has become the basis upon which Stewart bases investment strategies.

"I was in Canada skiing with a girlfriend and her family's wealth was managed by Dimensional," Stewart said.

"Her father said I think you need to talk to my adviser because there is a different way of thinking. The little boy from New Zealand was given an introduction - an introduction that is hard to quantify in terms of its value for me."

When KiwiSaver has launched five years ago, Stewart pitched the idea of Stewart Group tailoring its own KiwiSaver fund to his father and fellow director Donald.

"I said to him, 'we cannot give advice when we cannot put our hand on our heart and say it's perfect and aligns with our investment philosophy.' Which meant all of a sudden there was an area of the advice market that we were saying no to. You can't keep going like that - our clients need advice in certain areas.

"So we said if we can't get a product, we will make a product.

"A lot of the Dimensional guys had become friends, so when I put this into their world and said, gentlemen, I need you to help me to bring something better to New Zealand.

"We are from a small province that exports apples and lamb and we were asking for something pretty big.

"You can imagine the discussions in Austin, Texas, 'Hastings where?'."

The Americans came to the party, literally, at the Scots-themed launch on Friday in Hastings.

And why didn't Mr. Stewart mention the Canadian-girlfriend connection in his launch speech?

"Hell no, my wife was inside."

- Source: Patrick O'Sullivan, Hawke's Bay Today