Robert Burns believed wisdom belonged to everyone, not just the elite. Fast forward to today, and KiwiSaver reflects that same egalitarian spirit in finance. This article explores how Burns’ radical accessibility parallels the democratisation of investing in New Zealand. KiwiSaver isn’t just a savings scheme – it’s a structural shift that empowers every Kiwi to build wealth collectively. Discover why emotional intelligence and wise counsel matter as much as financial literacy.

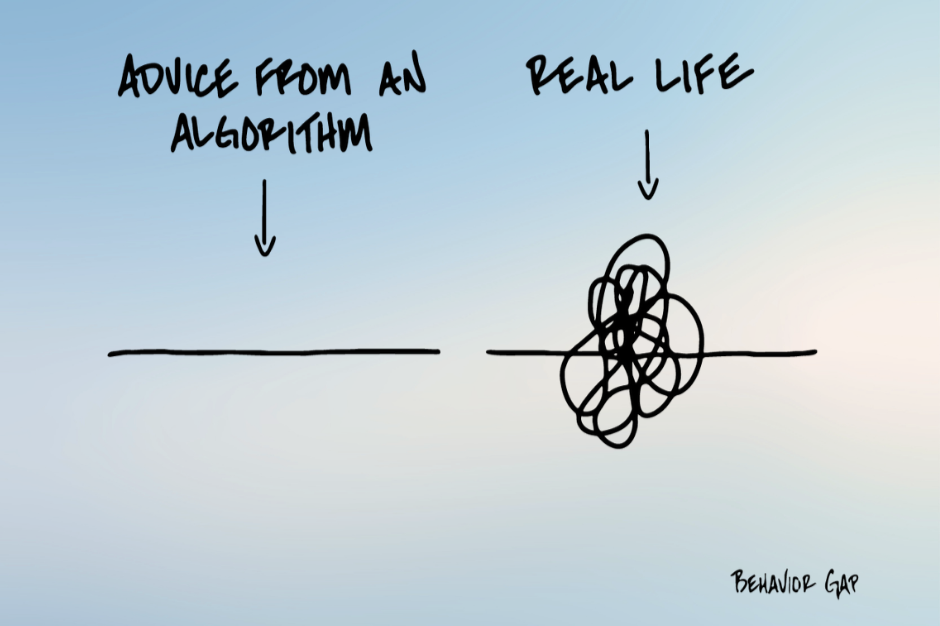

Taking Advice from Algorithms: Why the Messy Line Matters

You know what real life looks like? Messy. But you wouldn't know it from most financial plans – not algorithmic ones, anyway.

Most advice out there comes as a straight line. A tidy formula. Clean inputs, clean outputs. Do X, get Y! Save this percentage, retire at that age. Follow these steps, achieve this outcome.

But real life is messier. It's a chaotic tangle of loops and knots and unexpected detours.

And here's the thing about that mess—it's not a bug. It's not a sign you're doing it wrong. It's not evidence that you're bad with money or that you lack discipline. The mess is the point. The mess is what makes us human.

The Seduction of the Straight Line

There's something deeply appealing about algorithmic advice. It’s so clean. Plug in your numbers, and out comes a plan: no ambiguity, no second-guessing. Just follow the formula.

When you're overwhelmed by financial decisions, a straight line feels like relief. Someone—or something—finally has the answer. “Just tell me what to do, and I'll do it!”

Everything’s mapped out. It’s paint by numbers, just like when you were a kid.

But here's what the algorithm doesn't know: it doesn't know that your mother just got diagnosed with cancer and you're trying to figure out if you can afford to take unpaid leave. It doesn't know that your child is struggling in school and needs a tutor you hadn't budgeted for. It doesn't know that you just got an unexpected bonus and you're torn between paying down debt, investing, or finally taking that trip you've been postponing for five years.

The algorithm doesn't know that you're human, and life changes.

Why Math Isn't Enough

Don’t be mistaken - the maths matters. Of course it does! Compound interest is real. Time value of money is real. The difference between a 6% return and an 8% return over thirty years is very real.

But when we reduce money to maths alone, we forget what it feels like to make decisions when you're scared. Or uncertain. Or grieving. Or excited. Or exhausted. Or newly in love. Or watching your industry collapse. Or getting a second chance you never expected.

Financial decisions aren't made in a vacuum. They're made in the tangled middle of actual lives.

That's why human financial advice still matters. Not because humans are better at maths than machines—we're definitely not. But because good advisors know that the maths is just the beginning. The real work is helping people navigate the gap between what the spreadsheet says they should do and what feels possible in their actual circumstances.

Algorithms Optimise, Humans Navigate

Here's what I've learned after years of working with people and their money: algorithms optimise for efficiency. Humans navigate complexity.

An algorithm can tell you the mathematically optimal move. But it can't tell you whether that move is worth the fight it'll cause with your spouse. It can't weigh the emotional cost of saying no to your child’s sports travel team against the financial benefit of staying on track. It can't factor in the value of sleeping soundly at night, even if that means choosing a less "optimal" investment.

There's a reason Japanese retirement homes started removing robots and bringing back human caregivers.1 The robots were more efficient. They didn't get tired. They didn't call in sick. They could lift residents without risking back injuries. But the residents wanted the human touch. They wanted someone who could sense when they needed comfort, not just assistance. Someone who could respond to mood, not just medication schedules.

The same principle applies to money. The algorithm gives you the straight line. The human advisor helps you draw your actual path through the tangled mess.

And sometimes the best financial decision isn't the one that maximizes your net worth. Sometimes it's the one that lets you live with yourself. Sometimes it's the one that honours your values, even when it costs you. Sometimes it's the one that acknowledges you're not just a rational economic agent making optimal choices—you're a person trying to build a life that matters.

You Don't Know Where You Sit on the Curve

Late last year, I wrote about how no one actually knows where they sit on the curve of life's probabilities.2 The algorithm assumes average. But you're not living an average life—you're living your specific life, with your specific luck (good and bad) in any given year. My claims year proved that perfectly.

Some years, you sail through with nothing but routine expenses. The algorithm would call that "optimal."

Other years, everything hits at once. Three family emergencies, a job loss, a health scare, and a busted gearbox. The algorithm would call that "suboptimal" or "poor planning."

Yet, both years are just… life. You didn't do anything wrong in the hard year. You didn't do anything especially right in the easy year. You just lived as normal, where probability meets reality and the straight line becomes a scribble.

The Question Worth Asking

So here's what I want you to ask someone you care about today: What did your budget not account for this past year?

Budgets are great. I believe in them. But they're not magic. Real life always sneaks something in. The car repair. The friend's wedding at the other end of the country. The opportunity you couldn't pass up. The emergency that wasn't really an emergency but felt like one at the time.

Those deviations from the plan? They're not failures. They're data. They're information about what your life actually requires, not what the algorithm thinks it should require.

The straight line is beautiful. But the tangled mess is real. And real is where we have to learn to make good decisions.

Why We Still Seek Human Advice

Here's the deeper truth about why people still seek human financial advice in an age of robo-advisors and AI-powered planning tools: life is dynamic, and our responses need to be too.

A good financial plan isn't static. It breathes. It adapts. It changes when your circumstances change, when your values shift, when unexpected opportunities arise or unwanted challenges appear.

The algorithm updates when you feed it new numbers. The human advisor updates when they see the worry in your eyes, hear the excitement in your voice, sense the hesitation you can't quite articulate. They adjust not just to what has changed, but to how you've changed.

Because here's what the tangled mess really represents: not chaos, but adaptation. Not failure, but responsiveness. Not a deviation from the plan, but evidence that you're paying attention to your actual life and adjusting accordingly.

The straight line assumes the future will be like the past. The tangled line knows better. It knows that life zigs when you expect it to zag. It knows that the best plan is one that can bend without breaking, that can accommodate both disaster and delight, that can hold space for the full complexity of being human.

That's not a bug in the system. That's the whole point of having a life worth planning for.

Nick Stewart

(Ngāi Tahu, Ngāti Huirapa, Ngāti Māmoe, Ngāti Waitaha)

Financial Adviser and CEO at Stewart Group

Stewart Group is a Hawke's Bay and Wellington based CEFEX & BCorp certified financial planning and advisory firm providing personal fiduciary services, Wealth Management, Risk Insurance & KiwiSaver scheme solutions.

The information provided, or any opinions expressed in this article, are of a general nature only and should not be construed or relied on as a recommendation to invest in a financial product or class of financial products. You should seek financial advice specific to your circumstances from a Financial Adviser before making any financial decisions. A disclosure statement can be obtained free of charge by calling 0800 878 961 or visit our website, www.stewartgroup.co.nz

Article no. 440

References

James Wright's research on Japanese eldercare facilities found that care workers often rejected robots like the "Hug" lifting device, preferring to care with their own hands and finding it more respectful to residents. See: Wright, James. Robots Won't Save Japan: An Ethnography of Eldercare Automation (Cornell University Press, 2023); and MIT Technology Review's coverage of robot implementation challenges in Japanese care homes (January 2023). ↩

"Why Self-Insurance Rarely Works," Stewart Group, December 5, 2024 ↩

Should I Invest in What I Love? Product Affection vs Investment Logic

Personal product preferences are often the worst possible guide to investment decisions.

I remember when my family first got a GoPro. Revolutionary technology, stunning footage – everyone wanted one. Naturally, I thought: "This company is going places. Maybe I should buy shares." It's a seductive logic: if I love the product, surely others will too. A decade later, I'm thankful I didn't act on that impulse.

This instinct to invest in what we know and love feels intuitive. We use the products, we understand them, we see their value. But this emotional connection – what behavioural economists call "familiarity bias" – is precisely what makes it dangerous.

Back in 2014, GoPro went public and quickly hit a market capitalization of $10 billion with virtually no competition. Today? The stock trades around $1.87 per share – down 98% from its peak, with over $9.7 billion in market value lost.

What went wrong?

Smartphones killed the action camera star. Modern phones became waterproof, gained multiple lenses, and developed image stabilisation that rivals dedicated cameras. GoPro thought they were competing against other action cameras when they were actually competing against the most successful consumer device in history.

But here's the deeper lesson: loving a product tells you nothing about the company's competitive position or long-term viability. A great product is necessary but far from sufficient for investment success. In GoPro's case, every smartphone manufacturer became their competitor, each with deeper pockets and products consumers were already buying.

The Pattern Repeats Closer to Home

This isn't just an overseas story. Take My Food Bag – during COVID lockdowns, it seemed genius. The company went public in March 2021 at $1.85 per share, raising $342 million. Customers loved the service and bought shares. Many retail investors had enjoyed watching co-founder Nadia Lim cook on TV for years – hardly grounds for a wise investment decision. The result? Shares now trade around 25 cents – an 86% decline. As one fund manager noted, "It was a classic private equity exit, which has seen a lot of retail investors lose out."[1]

The timing seemed perfect. Lockdowns had created new habits. People were cooking at home more. The convenience model made sense. But investors failed to ask: what happens when lockdowns end? Is this a permanent behaviour shift or a temporary adaptation? How defensible is the business model? These are the uncomfortable questions that emotional attachment prevents us from asking.

As one fund manager noted, "It was a classic private equity exit, which has seen a lot of retail investors lose out."

Then there's Ryman Healthcare, beloved by many Kiwi families for good reason. My own family experienced the amazing care and kindness shown towards my late father during his time in the dementia care unit at Ryman in Havelock North. The quality of their villages is genuinely impressive. Yet despite these strengths, the stock hit $10.87 in December 2019 and now trades around $2.87 – down 74%. The investment thesis crumbled under construction delays and regulatory challenges, demonstrating that exceptional service doesn't automatically translate into strong investment returns.

This one hits close to home because the service was excellent. But gratitude and investment logic operate in different domains. A company can deliver outstanding customer experiences while simultaneously facing operational headwinds that undermine shareholder returns.

These three examples share a common thread: product or service quality created an emotional connection that clouded rational investment analysis.

The Evidence Against Emotional Investing

Behavioural finance research identifies "familiarity bias" as a major driver of poor investment decisions, where investors favour what they know rather than what performs best.[2] This bias is particularly pronounced amongst long-term investors who believe they're securing against volatility when they're actually concentrating risk.

The evidence against stock picking is overwhelming:

An Arizona State University study by Professor Hendrik Bessembinder examining over 28,000 stocks from 1926 to 2024 found that just 4% of firms created all net wealth in the U.S. stock market. The remaining 96% collectively matched Treasury bills over their lifetimes, and the majority of individual stocks actually reduced shareholder wealth compared to holding cash.[3]

Think about that. If you picked a stock at random, you'd have better than even odds of underperforming cash. The market's impressive returns come from a tiny fraction of companies – and identifying them in advance is nearly impossible.

Professional fund managers fare no better. S&P Dow Jones Indices' SPIVA Scorecard shows that after 10 years, approximately 85% of large-cap funds underperform the S&P 500, and after 15 years, around 90% trail the index.[4] Even Warren Buffett admits: "In 58 years of Berkshire management, most of my capital-allocation decisions have been no better than so-so."[5]

These aren't amateur investors. These are professionals with research teams, Bloomberg terminals, insider access, and decades of experience. If they can't beat a simple index fund, what makes individual investors think they can, especially when driven by product affection rather than analysis?

The Smart Money Questions

Instead of asking "Do I love this product?", evidence-based investors ask: How big is the addressable market? What prevents competitors from copying this? How strong are the financials? Is the company innovating fast enough? What could make this product obsolete?

These questions are deliberately uncomfortable because they force you to look beyond your emotional attachment. They require research, analysis, and a willingness to acknowledge uncertainty. Most importantly, they shift the focus from "I like this" to "can this company maintain a durable competitive advantage?"

The answers usually point to the same solution: diversification. Diversified index funds consistently outperform stock picking over the long term, providing market-matching returns while reducing the risk of catastrophic losses from individual stock failures.[6]

Diversification isn't glamorous. There's no story to tell at dinner parties about your clever stock pick. But it's precisely this lack of excitement that makes it effective. By owning the entire market, you guarantee you'll own the 4% of companies that generate all the wealth creation, without needing to predict which ones they'll be.

As a fee-only adviser working with evidence-based strategies, the real value isn't in chasing hot stocks or validating product obsessions. It's in building a robust financial plan grounded in decades of research, then maintaining discipline through market noise and emotional temptation.

This discipline is harder than it sounds. When GoPro was soaring, when My Food Bag was listing during lockdowns, when you're genuinely grateful for care received – the emotional pull to invest is powerful. It feels like you have special insight. You don't. You have an emotional connection clouding your judgment.

The most valuable thing a good adviser provides isn't stock tips or market predictions. It's the voice of reason when your emotions are screaming at you to invest in what you love. It's the person who asks the uncomfortable questions: "Have you analyzed the competitive landscape? What's your exit strategy? How does this fit your overall plan?" These questions aren't exciting, but they're essential.

Seek wise counsel, commit to a plan that aligns with your goals, and redirect that energy from stock-picking to living your life. Enjoy the products you love. Be grateful for excellent service. Just don't confuse these feelings with investment insight.

Your future self will thank you for choosing evidence over emotion.

Nick Stewart

(Ngāi Tahu, Ngāti Huirapa, Ngāti Māmoe, Ngāti Waitaha)

Financial Adviser and CEO at Stewart Group

Stewart Group is a Hawke's Bay and Wellington based CEFEX & BCorp certified financial planning and advisory firm providing personal fiduciary services, Wealth Management, Risk Insurance & KiwiSaver scheme solutions.

The information provided, or any opinions expressed in this article, are of a general nature only and should not be construed or relied on as a recommendation to invest in a financial product or class of financial products. You should seek financial advice specific to your circumstances from a Financial Adviser before making any financial decisions. A disclosure statement can be obtained free of charge by calling 0800 878 961 or visit our website, www.stewartgroup.co.nz

Article no. 437

References

My Food Bag Group Limited. (2024-2025). Financial Results and Market Updates. NZX Announcements. Retrieved from https://investors.myfoodbag.co.nz/

Devon Funds Management. (2025). "My Food Bag Investment Analysis." RNZ Business Interview, May 22, 2025.

Huberman, G. (2001). Familiarity breeds investment. Review of Financial Studies, 14(3), 659–680. https://doi.org/10.1093/rfs/14.3.659

Chew, S.H., Li, K.K., & Sagi, J. (2023). Home bias explained by familiarity, not ambiguity. Social Science Research Network. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3870716

De Vries, A., Erasmus, P.D., & Gerber, C. (2017). The familiar versus the unfamiliar: Familiarity bias amongst individual investors. Investment Analysts Journal, 46(1), 24-39.

Bessembinder, H. (2024). Shareholder wealth enhancement, 1926 to 2022 (Updated through 2024). Arizona State University, W.P. Carey School of Business. Retrieved from https://wpcarey.asu.edu/department-finance/faculty-research/do-stocks-outperform-treasury-bills

Bessembinder, H. (2018). Do stocks outperform Treasury bills? Journal of Financial Economics, 129(3), 440-457.

S&P Dow Jones Indices. (2024). SPIVA U.S. Scorecard Year-End 2024. Retrieved from https://www.spglobal.com/spdji/en/documents/spiva/spiva-us-year-end-2024.pdf

Berkshire Hathaway Inc. (2022). Letter to Shareholders. Annual Report 2022.

Malkiel, B.G. (2019). A random walk down Wall Street: The time-tested strategy for successful investing (12th ed.). W.W. Norton & Company.

Bogle, J.C. (2017). The little book of common sense investing: The only way to guarantee your fair share of stock market returns (10th anniversary ed.). John Wiley & Sons.

Fama, E.F., & French, K.R. (2010). Luck versus skill in the cross-section of mutual fund returns. The Journal of Finance, 65(5), 1915-1947.

Don't Let Your Adviser's Retirement Disrupt Yours

If you're planning your retirement with a financial adviser who's anywhere near retirement age themselves, you might be setting yourself up for a nasty surprise.

Recent industry data indicates only 10-20% of financial advisers have a documented succession plan, despite many advisers being in their mid-50s and planning to retire within the next decade. Meanwhile, 83% of people with advisers worry about what happens when their adviser retires, and more than half fear they won't receive any warning at all.

That's not just a statistic. It's a wake-up call for Kiwi investors.

You'll Likely Outlive Your Adviser's Career

If you retire at 65, you're likely to live another 25-30 years. According to Stats NZ, life expectancy for a 65-year-old New Zealander is currently 20.6 years for men and 23.2 years for women – and those figures continue to improve over time. Many Kiwis will live well into their 90s, with centenarians becoming increasingly common.

Now consider this: if your 60-year-old adviser plans to work until they're 70, that gives you just 5-10 years of their guidance during a retirement that could span three decades. You'll almost certainly outlive their working life, and quite possibly outlive them entirely.

The mismatch is stark. You need financial guidance for 25-30+ years, but your peer-age adviser might only be around for a third of that journey. Without a proper succession plan, you're facing two decades of uncertainty at precisely the time you need stability most.

The Hidden Risk in Your Financial Plan

Think about the irony for a moment. You hire a financial adviser to help you plan for decades of retirement, ensuring you'll never run out of money or face unexpected disruptions… Yet the person guiding you through this process often hasn't done the same planning for their own practice.

When an adviser retires without a proper succession plan, clients typically get assigned to someone new. Often, it’s someone they've never met.

The investment philosophy might change. The service style could be completely different. It's a bit like when your GP retires without warning and you're left scrambling to find someone new who understands your goals and history.

If you're pre-retirement (around 55 or 60) and working with an adviser who's 65 with no succession plan, you're practically guaranteeing yourself a disruptive transition right as you enter retirement. Even if that adviser works until 70 or 75, you'll still need another 15-20 years of advice after they're gone.

Why Advisers Avoid This Conversation

The reluctance to plan succession isn't malicious; it's deeply human. Creating a proper succession plan requires advisers to share their revenue with younger team members, invest significant time in training and mentoring, and confront their own career endings.

Many simply prefer to coast into semi-retirement rather than undertake this difficult work.

But their comfort shouldn't come at your expense, especially when you're planning for a retirement that could easily span three decades.

What a Proper Succession Looks Like

A well-executed succession plan doesn't happen overnight. The best transitions span multiple years, giving you time to build relationships with next-generation advisers while your current adviser gradually steps back.

You should see:

Early introductions to the advisers who will eventually manage your portfolio

Gradual transitions where new advisers take on increasing responsibility over 3-7 years

Consistent philosophy ensuring your investment approach doesn't change with personnel

Clear communication about the timeline and process

Demonstrated commitment such as ownership stakes for next-generation advisers

Age diversity on the advisory team to ensure continuity

Again, think of it like shopping for a family doctor. You don't want someone in their late 60s or 70s; you want someone who can look after you for multiple decades into the future. The same logic applies to your financial adviser, perhaps even more so given the 25-30 year timeframe you're planning for.

An adviser in their 30s or 40s can realistically serve you throughout your entire retirement. An adviser in their 60s simply cannot, no matter how skilled or dedicated they are.

This doesn’t mean you can’t get advice from an adviser in this age bracket – simply that you need to ask questions about the future.

7 Questions to Ask About Adviser Succession

Don't wait for your adviser to bring it up. Take control by asking:

Do you have a documented succession plan?

Who will work with my family when you retire?

Have I already met this person, or are they yet to be hired?

What's the age range of your advisory team?

How will you ensure my investment approach, services, and fees remain consistent?

What's the timeline for this transition?

Given I might need advice for another 25-30 years, how does your firm plan to serve me throughout my entire retirement?

If your adviser seems uncomfortable or unprepared to answer these questions, that tells you everything you need to know.

Building Succession Into Your Planning

Smart financial planning means thinking holistically about risk. You diversify your investments through KiwiSaver and other portfolios, maintain emergency funds, and plan for healthcare costs. Adviser succession should be part of that same risk management framework.

If you're in your 40s, you might have more flexibility, but you should still favour advisers with clear succession plans. If you're approaching retirement, this becomes non-negotiable. You need an advisory team that can serve you for the next 30 years, not just the next five.

Look for firms that have already made the hard choices – those that have hired and trained next-generation advisers, documented processes and consistent philosophies, and made those younger advisers actual owners in the business. This isn't just good planning; it's a commitment to their clients' long-term wellbeing.

The Bottom Line

Your financial security is too important to leave to chance. The adviser helping you plan for decades of retirement should have spent at least as much time planning for their own succession.

The actuarial reality is clear: at 65, you're looking at potentially 25-30 years of retirement. Your peer-age adviser simply won't be working that long. The question isn't whether succession will happen – it's whether it will happen with planning and care, or chaos and disruption.

Ask the hard questions now. If the answers don't satisfy you, it might be time to find an adviser who's as committed to your future as you are.

Nick Stewart

(Ngāi Tahu, Ngāti Huirapa, Ngāti Māmoe, Ngāti Waitaha)

Financial Adviser and CEO at Stewart Group

Stewart Group is a Hawke's Bay and Wellington based CEFEX & BCorp certified financial planning and advisory firm providing personal fiduciary services, Wealth Management, Risk Insurance & KiwiSaver scheme solutions.

The information provided, or any opinions expressed in this article, are of a general nature only and should not be construed or relied on as a recommendation to invest in a financial product or class of financial products. You should seek financial advice specific to your circumstances from a Financial Adviser before making any financial decisions. A disclosure statement can be obtained free of charge by calling 0800 878 961 or visit our website, www.stewartgroup.co.nz

Article no. 434

Acknowledgements

Special thanks to Keith Matthews of Tulett Matthews and Associates for exploring this critical topic on the Empowered Investor Podcast and highlighting the importance of adviser succession planning for investors approaching retirement.

References

Investment Planning Council (IPC) survey of 1,500+ Canadians with financial advisers, cited in Tulett Matthews & Associates, "Empowered Investor Podcast Episode 120: Don't Let Your Adviser's Retirement Disrupt Yours" (October 2024)

Stats NZ, "National and subnational period life tables: 2017–2019" - Life expectancy data for 65-year-olds in New Zealand

Industry research on adviser succession planning cited in Tulett Matthews & Associates podcast, showing 10-20% of advisers have documented succession plans, with average adviser age of 54 years

When Ideology Replaces Analysis: The Sparrow Lesson for Investors

It's fairly well known that Mao Zedong's Great Leap Forward (1958–1962) ended in one of history's deadliest famines: tens of millions died, villages emptied by hunger, fields stripped bare. What's less well known is how a war on sparrows helped set the catastrophe in motion. [1]

‘Ed Brown’ by Michael Parekowhai, 2000 - A favourite of Nick’s that hangs on the wall at home.

In 1958, Mao launched the Four Pests Campaign, targeting rats, flies, mosquitoes… and sparrows. The tiny birds, he decreed, were "enemies of the people" for daring to eat the people's grain. [2]

And so, an entire civilisation mobilised against the feathered menace. Schoolchildren banged pots and pans in the streets, peasants drummed on washbasins, and factory sirens screamed for hours to keep the birds in flight until they fell dead from exhaustion. Nests were torn down, eggs smashed, and chicks stomped into the earth.

The results were biblical. In Beijing alone, more than a million sparrows were killed in a matter of weeks. Rural communes competed to see who could pile the highest mountain of avian corpses, a kind of grotesque festival of progress.

But victory, when it came, was short-lived. The sparrows, it turned out, had been eating more insects than grain. Within a year, the skies were empty, and the earth was crawling. Locusts rose like living clouds, devouring fields from horizon to horizon. Peasants watched in horror as the crops disappeared into the mandibles of an unstoppable plague of their own making.

Rather than admit his mistake, Mao doubled down on absurdities. He replaced the sparrows with imported Soviet "science" – the theories of Trofim Lysenko, an agronomist who believed that crops could be re-educated through hard labour. Genetics was bourgeois nonsense, Lysenko said; what mattered was enthusiasm. If you ploughed deeper, planted closer, and shouted revolutionary slogans loudly enough, the harvest would multiply.

So, fields were churned to depths that eviscerated the biome, seedlings were planted shoulder to shoulder until none could breathe, and bureaucrats inflated yields to impossible heights. Mountains of fake grain were reported; much of the real grain was exported to show socialist success.

By 1960, China was starving. Whole provinces were dying in silence. Still, the propaganda blared: "The people's communes are good!"

A survivor later put it simply: "We killed the birds, and then the insects ate everything else."

New Zealand's Sacred Cow

We have our own version of Lysenko's ideology. You've heard it at every barbecue, every family gathering, every pub conversation about money:

"You can't go wrong with bricks and mortar."

"Buy land – God's not making any more of it."

"Rent money is dead money."

"Safe as houses."

"Property always goes up."

For two decades, these mantras proved prophetic. House prices in Auckland rose 500% between 2000 and 2021. Kiwi households saw their home become their retirement plan, their children's inheritance, their ticket to prosperity. Property investment became a religion, complete with its own prophets (real estate agents), its own evangelists (property coaches), and its own scripture (Rich Dad Poor Dad).

The scriptures were simple: leverage to the hilt, buy multiple rentals, negative gear against your income, and watch the capital gains roll in. Interest rates were at historic lows (and surely they'd stay there forever). The government needed house prices to keep rising; from pensioners to banks, the entire economy seemed to float on residential property values.

Alas - ideology, no matter how many believers it has, eventually meets mathematical reality.

When the Locusts Arrived

When the Reserve Bank lifted the Official Cash Rate from 0.25% to 5.5% between 2021 and 2023, the proverbial locusts began to swarm and feast. [3]

Investors who'd stretched to buy rental properties on interest-only loans at 2.5% suddenly faced repayments double what they'd planned for. Those who'd bought at the peak in 2021, with the assumption that prices would continue relentlessly marching upward, now watched their equity disappear into the maw of change.

The median house price in New Zealand has fallen 18% from its 2021 peak according to CoreLogic, with steeper declines in some regions. In Wellington, prices dropped over 20%. [5], [4]

Investors who bought at the top, banking on endless capital gains to compensate for negative cash flow, are now holding properties worth less than their mortgages. Negative equity isn't just an American problem from the 2008 crisis anymore; it's arrived in Epsom and Island Bay, in Christchurch and Hamilton. [5]

Mortgage stress has become a daily reality for thousands of New Zealand families. What was affordable at 2.5% is crushing at 7%. Property gambles that made sense when you could lock in cheap debt for years, now bleed money every month.

The Property Value Fundamentals We Ignored

Like Mao's bureaucrats ignoring the ecology of pest control, New Zealand ignored the fundamentals that underpin property values:

1. Debt serviceability

We convinced ourselves record-low interest rates were the new normal; a pleasantly permanent feature of the economic landscape.

They weren't. They were weather, not climate.

Anyone who'd stress-tested their mortgage at 7% rates had a good idea what this would look like, but most didn't bother. After all, the Reserve Bank had signalled rates would stay low until 2024, hadn't they? (They had. They were wrong.)

2. Yield vs. cost

Rental properties returning 3% gross yield while mortgages cost 7% represents what economist Hyman Minsky termed "Ponzi finance"—where income flows cover neither principal nor interest charges, requiring continuous new debt or capital appreciation to survive [6]. When prices stopped rising, the mathematics became unavoidable. You can't lose money every month and call it investing just because you hope the asset will appreciate.

3. Supply and demand

Yes, God's not making more land. But man is making more zoning laws, more construction, and more high-density housing. Auckland's recent upzoning has added the potential for tens of thousands of new dwellings. National's push for urban intensification is changing the supply equation.

Supply does respond to price eventually. The assumption that demand would endlessly outstrip supply was ideology, not analysis.

4. Demographic and economic shifts

Net migration swings wildly:

We saw massive outflows to Australia when its economy boomed.

Birth rates are falling.

Working from home changed where people want to live, making provincial cities more attractive.

How to Avoid Being the Sparrow Killer

No investment is exempt from fundamental analysis – not even the quarter-acre Kiwi dream. Here’s what you need to do:

Test your assumptions first

Before buying property (or any investment), ask the hard questions: Can I afford this if interest rates hit 8%? What if the property stays vacant for three months? What if it needs a $30,000 roof replacement? What if prices don't rise for a decade—can I still hold on? If your investment only works under best-case scenarios, you're not investing—you're gambling with borrowed money.

Recognise ideology masquerading as wisdom

When someone says "you can't go wrong with property”: ask them about Japan, where house prices fell for fifteen consecutive years after 1991 with Tokyo property losing 60% of its value. Or Ireland, where property crashed 50% in 2008-2012. Or Detroit, where homes now sell for less than second-hand cars. [6]

The phrase "you can't go wrong" is the most dangerous in investing. You absolutely can go wrong with property, shares, bonds, or any other asset – when you pay too much, borrow too heavily, or ignore the fundamentals.

Understand that all assets are priced relative to alternatives

When term deposits paid 0.5%, property's 3% gross yield looked attractive by comparison. At 5.5% risk-free rates from the bank, suddenly that leveraged rental property earning 3% gross (maybe 1% after rates, insurance, maintenance, and management) looks substantially less clever. Capital always flows to its best risk-adjusted return. When safe returns become attractive again, risky assets must reprice.

Seek Wise Counsel

Honest, professional financial advice isn’t just valuable in these situations; it’s essential.

Not the mate at the barbecue repeating what worked in 2015. Not the property spruiker selling $5,000 weekend seminars on wealth creation. Not the Instagram influencer with a Lamborghini, a course to sell, and a P.O. box in the Cayman Islands.

Find an adviser who'll tell you hard truths instead of comfortable lies. Someone who'll stress-test your assumptions, challenge your thinking, and ask the questions you don’t want to acknowledge:

What if you're wrong?

What if rates stay high for five years?

What if prices don't recover for a decade?

What does your portfolio look like if this happens?

The best financial advice often sounds boring. That’s because it is boring: it involves diversification across asset classes, appropriate leverage you can service in bad times, understanding what you own and why, and planning for scenarios you hope won't happen.

It's not a catchy slogan you can repeat at a dinner party. It's certainly not exciting enough to build a social media following around.

Instead, it's mathematics, discipline, humility, and the wisdom to know that "everyone's doing it" has never – not once in the history of markets – been a sound investment strategy. Quite the opposite; when everyone's doing it, that’s usually a good moment to step back and ask why.

Mao surrounded himself with yes-men who told him what he wanted to hear. The sparrows paid the price. Then the insects thrived. Then the people paid the price. The echo chamber produced catastrophe because ideology replaced observation, and enthusiasm replaced analysis.

The Bottom Line for Kiwi Investors

Don't let your financial future be decided by mantras. Don't let social ‘proof’ substitute for due diligence. And crucially, don't assume what has worked for the past twenty years will work for the next twenty.

Instead, seek counsel that respects the complexity of markets, acknowledges uncertainty honestly, understands risk as well as reward, and helps you build wealth on foundations stronger than popular sentiment or revolutionary enthusiasm.

The fundamentals always win. Always. The only question is whether you'll be positioned to weather the fallout, or whether you’ll be left exposed in the fields.

The locusts are always waiting.

Nick Stewart

(Ngāi Tahu, Ngāti Huirapa, Ngāti Māmoe, Ngāti Waitaha)

Financial Adviser and CEO at Stewart Group

Stewart Group is a Hawke's Bay and Wellington based CEFEX & BCorp certified financial planning and advisory firm providing personal fiduciary services, Wealth Management, Risk Insurance & KiwiSaver scheme solutions.

The information provided, or any opinions expressed in this article, are of a general nature only and should not be construed or relied on as a recommendation to invest in a financial product or class of financial products. You should seek financial advice specific to your circumstances from a Financial Adviser before making any financial decisions. A disclosure statement can be obtained free of charge by calling 0800 878 961 or visit our website, www.stewartgroup.co.nz

Article no. 432

References

[1] F. Dikötter, *Mao's Great Famine: The History of China's Most Devastating Catastrophe, 1958–-1962*.. London: Bloomsbury Publishing, 2010.

[2] J. Shapiro, *Mao's War Against Nature: Politics and the Environment in Revolutionary China*.. Cambridge: Cambridge University Press, 2001.

[3] Reserve Bank of New Zealand, “Official Cash Rate decisions and historical data,”, 2024. [Online]. Available: https://www.rbnz.govt.nz

[4] Real Estate Institute of New Zealand (REINZ), “Historical house price data and market statistics,”, 2024. [Online]. Available: https://www.reinz.co.nz

[5] CoreLogic New Zealand, “House price indices and market analysis reports,”, 2024. [Online]. Available: https://www.corelogic.co.nz

[6] H. P. Minsky, “The Financial Instability Hypothesis,”, The Jerome Levy Economics Institute Working Paper No. 74, 1992.

NZ's Economic Costume: Why Kiwis Feel Poor Despite Being "Rich"

Tonight is Halloween - a celebration of masks, illusions, and things that appear frightening but aren't real. How fitting, then, to discuss New Zealand's latest economic costume: the world's fifth-wealthiest country per capita, according to Allianz's latest Global Wealth Report.[1]

Each Kiwi is apparently worth $617,000 on average. Pop the champagne, right? Not quite.

The mask of prosperity doesn't quite match the face underneath. Most New Zealanders are too busy checking their bank balances and wincing at grocery receipts to celebrate this dubious honour.

At a recent conference abroad, colleagues from other nations questioned why New Zealanders exhibit such a "small dog complex" about our economy and stock market when we rank so highly in global wealth tables. "You must be a very wealthy nation," they observed, puzzled by our apparent lack of confidence. Their bewilderment was understandable—on paper, we look remarkably prosperous.

But the disconnect between this glowing statistic and daily financial reality reveals something troubling about how we measure prosperity - and exposes an uncomfortable truth about New Zealand's economic decline. Our "complex" isn't insecurity. It's realism.

A Nation of Landlords

Napoleon famously dismissed Britain as "a nation of shopkeepers"; a merchant class focused on trade rather than grand imperial pursuits.

If the French Emperor were observing New Zealand today, he might call us "a nation of residential landlords." We've become obsessed with buying and selling houses to one another. We treat property as our primary investment vehicle and wealth-creation strategy.

That impressive $617,000 wealth figure is overwhelmingly driven by this fixation: property values.[2] Housing represents approximately 50-58% of New Zealand household wealth.[3] Yet curiously, when the Herald reports that stripping out real estate sees us drop only to eighth place in net financial assets, something doesn't add up. If more than half our wealth is property, removing it should see us plummet far further down the rankings.

This data inconsistency itself reveals the problem: international wealth comparisons struggle to accurately capture economies where asset bubbles distort the picture. Regardless of the exact ranking, the core truth remains – housing wealth is fundamentally different from productive wealth.

If you own a $1.2 million house in Auckland, congratulations on being wealthy on paper. But alas, you can't pay for petrol with housing equity. That "wealth" is locked away, inaccessible unless you sell and move somewhere cheaper (which increasingly means moving south or to Australia[4]). Meanwhile, you're servicing a massive mortgage at interest rates that peaked above 7%.

For those who don't own property, the inflated housing market represents the opposite of wealth. It's a barrier that pushes homeownership further out of reach with each passing year.

We've become experts at shuffling residential properties between ourselves while creating little new productive value. The resulting "wealth" is a mirage. It makes the statistics look good while leaving people feeling financially squeezed.

The GDP Reality Check

Here's where the wealth ranking crumbles entirely. New Zealand's GDP per capita tells a completely different story. In the 1950s, New Zealand ranked third globally in GDP per capita. Today? We've plummeted to 37th.[5]

GDP per capita – which measures actual economic output and productivity – sits more than 20% below the OECD average. The Productivity Commission noted we should be 20% above that average given our policy settings, but we're achieving the exact opposite. As one economist bluntly put it: "We may be punching above our weight, but that's only because we are in the wrong weight division."[6]

In 2024's economic performance rankings, New Zealand placed 33rd out of 37 OECD countries.[7] We beat only Finland, Latvia, Turkey, and Estonia. Per capita output has been declining since December 2022.[5]

These are not the statistics of a wealthy, thriving nation.

When you lay bare these numbers, Kiwis' so-called "small nation complex" makes perfect sense. We're not suffering from false modesty; we're experiencing economic reality the wealth rankings fail to capture.

The Debt Burden

The wealth figures also conveniently ignore what we owe. New Zealand and Australia have seen their debt ratios surge by 15.2 percentage points to reach 113% of GDP.[1] High asset values paired with equally high debt levels mean many households are drowning in mortgage payments, leaving little for savings or discretionary spending.

The Reserve Bank was among the world's most aggressive in raising interest rates, and the economy has faltered accordingly.[5] Per capita output has contracted while unemployment climbs. Firms are downsizing. This is the lived experience behind the statistics—and it bears no resemblance to the fifth-wealthiest nation on earth.

Sixty Years of Relative Decline

The long view is sobering. New Zealand has been growing significantly slower than other OECD countries for six decades.[6] We've dropped from elite economic status to below-average performer. Our isolation, small market size, and weak productivity growth have compounded into structural disadvantages that successive governments have failed to overcome.

The wealth ranking actually highlights our problem. We've substituted asset appreciation for genuine economic growth. Rather than building productive capacity, improving wages, or fostering innovation, we've watched house prices soar and called it prosperity.

Napoleon's shopkeepers at least sold goods to customers beyond their own shores. Our landlords primarily rent to each other.

The Need for Fiduciary Advice

For individuals navigating this challenging economic landscape, the disconnect between headline wealth and financial reality makes professional guidance more critical than ever. Understanding the difference between illiquid property wealth and accessible financial assets, managing debt strategically in a high-interest environment, and building genuine financial resilience requires expertise beyond newspaper headlines.

Working with a qualified financial adviser who operates under fiduciary duty – i.e. is legally obligated to act in your best interests – can help cut through the noise. Whether you're trying to balance mortgage stress with retirement savings, questioning if your "wealth" is working effectively, or simply wondering why the statistics don't match your bank account, professional advice tailored to your specific circumstances is invaluable.

The gap between perception and reality has never been wider. Kiwis understand what the statistics obscure: you can't eat your house equity, and paper wealth means nothing when your purchasing power is eroding. What my international colleagues mistook for a national inferiority complex is actually clear-eyed recognition of our economic challenges. In uncertain times, sage financial counsel from a trusted fiduciary adviser isn't a luxury. It's essential for turning illusion into genuine security.

Nick Stewart

(Ngāi Tahu, Ngāti Huirapa, Ngāti Māmoe, Ngāti Waitaha)

Financial Adviser and CEO at Stewart Group

Stewart Group is a Hawke's Bay and Wellington based CEFEX & BCorp certified financial planning and advisory firm providing personal fiduciary services, Wealth Management, Risk Insurance & KiwiSaver scheme solutions.

The information provided, or any opinions expressed in this article, are of a general nature only and should not be construed or relied on as a recommendation to invest in a financial product or class of financial products. You should seek financial advice specific to your circumstances from a Financial Adviser before making any financial decisions. A disclosure statement can be obtained free of charge by calling 0800 878 961 or visit our website, www.stewartgroup.co.nz

Article no. 431

References

[1] Allianz Global Wealth Report 2025. Available at: https://www.allianz.com/en/economic_research/publications/specials_fmo/global-wealth-report.html

[2] New Zealand Herald (October 2024). "New Zealand ranks among world's top five wealthiest countries per capita in rich list report." Available at: https://www.nzherald.co.nz/business/new-zealand-ranks-among-worlds-top-five-wealthiest-countries-per-capita-in-rich-list-report/MX2QDDZWXFBBNF3NT5734XTW3E/

[3] New Zealand Treasury (2023). "Estimating the Distribution of Wealth in New Zealand." Working Paper 23/01. Available at: https://www.treasury.govt.nz/sites/default/files/2023-04/twp23-01.pdf

[4] Statistics New Zealand (July 2025). "Net migration loss to Australia in 2024." New Zealand recorded a net migration loss of 30,000 people to Australia in 2024, the largest calendar-year loss since 2012. The South Island's population grew at 1.4% annually (faster than the North Island's 1.3%), with Canterbury's Selwyn District and Queenstown-Lakes experiencing the fastest growth rates. Available at: https://www.stats.govt.nz/news/net-migration-loss-to-australia-in-2024/

[5] RNZ News (December 18, 2024). "NZ ranks low in global economic comparison for 2024." Available at: https://www.rnz.co.nz/news/business/537075/nz-ranks-low-in-global-economic-comparison-for-2024

[6] New Zealand Productivity Commission. "Economic Performance and Productivity Analysis." Referenced in Economy of New Zealand, Wikipedia. Available at: https://en.wikipedia.org/wiki/Economy_of_New_Zealand

[7] The Economist (December 2024). "OECD Economic Performance Rankings 2024."

The Price of Wisdom: What Financial Advice Is Really Worth

Russell Investments has done something rather brave: it has attempted to reduce the value of financial advice to a single number. That number, for 2025, is 4.52%.

The precision is almost comical. Not 4.5%, not "around 4 or 5%", but 4.52% – calculated to two decimal places, as if this were physics rather than the messy business of helping people not wreck their retirements. But even if the decimal places are a bit of theatre, the exercise forces an uncomfortable question into the open: what exactly are financial advisers selling, and is it worth the fee?

Investment Lessons from 1987 and 2021

New Zealanders have long memories when it comes to financial disasters. However, we seem doomed to repeat them in different asset classes.

The 1987 sharemarket crash created a generation-long aversion to equities that arguably cost Kiwi investors more than the crash itself. Those who fled shares and never returned missed decades of recovery and growth. Fast forward to the 2020s, and the only real change was the flavour of asset class in question. Property replaced shares as the "safe" investment – the thing that "always goes up." Except… it didn't.

The residential property market's dramatic decline from its 2021 peak caught out a generation of leveraged investors who'd been assured that bricks and mortar were different. Investors who'd borrowed heavily to accumulate multiple properties found themselves drowning as interest rates climbed and property values plummeted.

Russell's data shows that investors who stayed invested in the New Zealand sharemarket over the past decade outperformed those who missed just the 10 best trading days by 3.57% annually. Miss the 40 best days, and you're 60% worse off.

The expensive lesson: panic is usually more costly than the crisis that triggered it. As is the herd mentality that drives people into overvalued assets for fear of missing out.

What You're Actually Paying for with Professional Advice

The Russell report is admirably blunt about what advisers actually do.

Strip away the corporate language about "behavioural coaching" and the message is clear: advisers are worth paying primarily because they stop you from doing something catastrophic – whether that's panic-selling during downturns or panic-buying during manias.

That 4.52% breaks down like this:

3.57% comes from preventing fear-based or greed-based decisions

0.2% from helping choose appropriate risk levels

0.75% from customising wealth plans.

The rest – the "emotional and technical expertise" of seasoned advisers – is declared "priceless."

What you're paying for isn't genius stock-picking or property market timing. You're paying someone to tell you uncomfortable truths – like that property yields in 2021 didn't justify the prices, that borrowing heavily into an overheated market was dangerous, and that diversification matters even when one asset class seems invincible.

What Russell Misses Entirely

But here's what Russell's tidy arithmetic utterly fails to capture: the value of comprehensive financial planning that extends well beyond investment returns.

1.Tax efficiency

This alone can dwarf that 4.52% in any given year. The difference between holding investments in the wrong structure versus the right one – PIE funds versus direct holdings, trusts versus personal ownership, the timing of realisations – can mean tens of thousands of dollars in a single tax year for even moderately wealthy families.

2. Asset protection

What's the percentage value of having your wealth properly structured so that a lawsuit, business failure, or relationship breakdown doesn't wipe out everything you've built? If disaster occurs, the value is effectively infinite.

3. Succession planning

This is even harder to reduce to basis points. What's it worth to ensure your estate passes efficiently to your children rather than being carved up by lawyers and the IRD? What's it worth to avoid family disputes over inheritances or ensure your business survives your death?

4. Risk management

Risk management extends beyond investment volatility. Adequate insurance coverage, appropriate policy structures, regular reviews as circumstances change – the value becomes apparent only in catastrophe but is no less real.

Support for The Goals That Matter

Perhaps most importantly, Russell's framework completely ignores what might be the highest value proposition: helping clients achieve what they really want from their wealth.

Financial plans aren't spreadsheet exercises. They're roadmaps to specific life goals – retiring early, funding children's education without debt, buying that bach, leaving a meaningful legacy, or achieving financial independence that allows career changes.

Consider these two real examples:

Example 1: Diversifying Portfolios for Property Accumulators

A professional couple in their early fifties came to us convinced they'd need to work until 65. They'd accumulated three rental properties during the boom years – two still carrying significant mortgages. They were stressed and beginning to resent the properties that were supposed to secure their future.

After comprehensive analysis, we restructured their affairs entirely. We helped them sell two properties, eliminated all personal debt, and repositioned their investments into a properly diversified portfolio with appropriate tax efficiency. The result? They retired at 58 with more financial security and significantly less stress. The value wasn't in the 4.52% – it was in getting seven extra years of freedom.

Example 2: Strategic Phased Retirement with Increased Tax Efficiency

A business owner approaching a potential sale came to us six months before signing a term sheet. Through careful structuring involving family trusts, timing of the sale, and strategic use of tax vehicles, we reduced his tax liability by over $300,000 – money that remained with his family rather than going to the IRD. More importantly, we helped him structure the proceeds to support a phased retirement that included funding his children's business ventures and establishing a charitable legacy.

These kinds of results don't show up in Russell's investment-centric quantification. But they're often what clients value most.

The Fiduciary Difference in Financial Advice

This is where the fee-only, fiduciary model becomes essential. When your adviser is paid solely by you – not by product commissions, not by mortgage brokers' referral fees, not by insurance kickbacks – all of these dimensions of advice become trustworthy.

Consider the property boom of the late 2010s and early 2020s. How many advisers benefited indirectly from encouraging clients toward leveraged property investment? A fee-only fiduciary has no such conflicts. Their only incentive is your long-term financial health.

A fiduciary investment adviser operating under frameworks like CEFEX certification isn't only preventing you from panic-selling equities; they're providing the disciplined portfolio construction and advice that can prevent over-concentration of one asset class in the first place.

The leveraged property investors of 2021 needed someone to tell them they were being greedy and foolish. Most didn't have that person. Or worse, they had advisers whose business models depended on encouraging behaviours that would later prove ruinous.

Investors need someone – a real person, with your best interest at heart – in their corner. An algorithm can rebalance a portfolio, but it can't talk someone out of borrowing a million dollars to buy their third rental property when yields don't justify prices. It certainly can't design a comprehensive wealth structure that addresses tax, protection, succession, and life goals simultaneously while adapting to changing circumstances over decades.

What Advice is Really Worth

The real value of fee-only fiduciary advice encompasses dimensions Russell doesn't even attempt to measure.

Behavioural coaching has genuine value. But reducing comprehensive financial advice to a single percentage derived from mainly investment considerations is like judging a surgeon's worth solely by their suturing speed rather than successful procedures.

The real value isn't in any spreadsheet. It's in the confidence of knowing someone is watching your back without any hidden agenda, the relief of having comprehensive planning that addresses tax, protection, and succession alongside investments, and the profound satisfaction of achieving what you set out to do with strategic wealth management.

It’s Time for a Different Conversation

If you're tired of product pitches masquerading as advice, or if you've outgrown the traditional model of financial guidance, perhaps it's time to try a different conversation – and we’re always happy to talk.

As a fee-only, CEFEX-certified fiduciary adviser, Stewart Group is legally and ethically bound to put your interests first – always. We don't receive investment commissions, referral fees, or any form of conflicted remuneration. Our only incentive is your success across all dimensions of your financial life.

Whether you're navigating a business sale, restructuring an investment portfolio that's grown unwieldy, planning for retirement that's closer than you'd like to admit, or simply wondering if there's a better way to structure your wealth – comprehensive fiduciary advice might serve you well.

The first conversation costs nothing but time. Why not contact us today, to arrange a confidential discussion about your financial circumstances and goals.

Nick Stewart

(Ngāi Tahu, Ngāti Huirapa, Ngāti Māmoe, Ngāti Waitaha)

Financial Adviser and CEO at Stewart Group

Stewart Group is a Hawke's Bay and Wellington based CEFEX & BCorp certified financial planning and advisory firm providing personal fiduciary services, Wealth Management, Risk Insurance & KiwiSaver scheme solutions.

The information provided, or any opinions expressed in this article, are of a general nature only and should not be construed or relied on as a recommendation to invest in a financial product or class of financial products. You should seek financial advice specific to your circumstances from a Financial Adviser before making any financial decisions. A disclosure statement can be obtained free of charge by calling 0800 878 961 or visit our website, www.stewartgroup.co.nz

Article no. 430

References

Russell Investments (2025). The Value of an Adviser: New Zealand Edition. Russell Investments.

Brokers Ireland (2025). The Value of Advice: A Whitepaper. Brokers Ireland.

Chaplin, D. (2025, October 14). "The value of financial advice (to two decimal points)". BusinessDesk.

The Paradox of Wealth Without Peace

Time: The One Thing No One Can Buy

God gives everyone 168 hours each week - 24 hours a day for 7 days. This time is a gift to be used wisely.

You can have $3 million in the bank and still feel poor.

I've seen it more times than I can count. Successful professionals sitting across from me, their financial statements telling one story whilst their faces tell another. On paper, everything looks perfect: high income streams, diversified portfolios, prestigious career trajectories, and assets that would make most Kiwis envious.

But beneath the surface? A different reality entirely.

Stress that follows them home every evening. Uncertainty that keeps them awake at 3 AM, staring at the ceiling. A quietly pervasive sense that, despite all their achievements, it's never quite enough.

The goalposts keep moving, the finish line keeps shifting, and the peace of mind they thought money would bring remains frustratingly elusive.

After working with hundreds of high-achievers, I've discovered this phenomenon rarely stems from what's visible on their balance sheets. Instead, it comes down to three invisible relationships that most people never examine. Yet these relationships shape everything: how they spend, save, think, and ultimately, how they feel about their financial lives.

These relationships don't just influence money decisions. They ripple through career choices, health habits, sleep quality, personal relationships, and long-term planning. Research consistently shows that financial well-being is more strongly correlated with psychological factors than absolute wealth levels¹. Understanding these relationships isn't just about financial wellness—it's about life wellness.

Relationship #1: Your Relationship with Money

Most people obsess over the numbers: net worth, income growth, investment returns, KiwiSaver balances. These metrics matter, but they're only part of the equation. The fundamental question few ever ask is, “What do I actually believe about money?”

Is money something you control, or something that controls you? Do you see it as a tool for freedom, or a source of anxiety? A measure of success… or a threat to your values?

Studies in behavioural economics demonstrate that our financial decisions are driven more by psychological factors than rational calculations². If your core beliefs about money were formed during times of scarcity, uncertainty, or financial stress, they may no longer serve the life you're building today. Many successful people still operate from the same financial fears they carried in their twenties and thirties, even after their circumstances have dramatically changed.

Your financial plan must reflect the life you want now, not the fears you carried decades ago. This means regularly examining and updating your money beliefs as you evolve. What felt prudent at 35 might feel restrictive at 55. What seemed risky in your early career might now represent exactly the kind of calculated risk that aligns with your values and goals.

Understanding your money personality provides crucial insight into why certain strategies feel right whilst others create internal conflict, regardless of their theoretical benefits.

Relationship #2: Your Relationship with Time

Time is the most underpriced asset in any portfolio, and it's the one asset people consistently undervalue in their decision-making.

You can recover money, but you cannot recover time.

Market downturns are temporary. Career setbacks can be overcome. Investment losses can be recouped. But the hours, days, and years you spend? They're gone forever.

Despite knowing this on an intellectual level, many high achievers continue to spend time like it’s unlimited. They optimise for financial returns whilst ignoring time returns.

“Money can’t buy happiness” – but time might

Research from Harvard Business School shows that people who prioritise time over money report higher levels of happiness and life satisfaction³. They'll spend hours researching a minor investment decision whilst giving little thought to how they're investing this most precious resource.

If your time isn't aligned with what truly matters to you, no amount of money will create the sense of freedom you're seeking. This is why some people with modest incomes feel genuinely wealthy whilst others with substantial assets feel trapped.

Real wealth isn't just about having money, it's about having choices. And choice is fundamentally powered by time:

The freedom to say no to opportunities that don't align with your values.

The ability to spend unhurried time with people you care about.

The luxury of pursuing interests that fulfil you, regardless of their financial return.

Think on how you spend your hours and ask, “does this reflect what I say matters most to me?” If there's a disconnect, all the financial success in the world won't create the life satisfaction you're seeking.

Relationship #3: Your Relationship with Yourself

This relationship is the most neglected yet the most powerful of the three.

Many successful people can articulate what success looks like in concrete terms. They can talk income level, asset targets, career milestones, even lifestyle markers – but they don’t know what success feels like on a personal level.

If you've never paused to define success for yourself—really define it, beyond external measures—you'll spend your life chasing someone else's version of it. You'll hit financial targets, career goals, and accumulate assets… but they won't create the security you thought they would.

Positive psychology research confirms that intrinsic motivations (personal growth, relationships, contribution) lead to greater well-being than extrinsic motivations (wealth, fame, status)⁴. This is why you can have a portfolio that's growing steadily and still feel fundamentally stuck. Your external wins are not as directly connected to your internal sense of progress and fulfilment as you might think.

Your relationship with yourself determines what is "enough." It shapes what risks feel worth taking and which ones feel reckless, and influences whether you see money as a tool for creating the life you want – or as a scorecard for proving your worth.

The Integration Point

These three relationships don't exist in isolation. Your beliefs about money affect how you value time, while your relationship with yourself shapes both your money beliefs and time choices.

When these relationships are aligned, financial decisions feel natural and sustainable. When they're in conflict, even objectively good strategies can create stress and resistance.

True financial wellness isn't just about having enough money. It's about ensuring your financial life reflects your actual values, supports your real priorities, and creates space for what genuinely matters to you.

Why Professional Guidance Matters

Understanding these three relationships intellectually is one thing. Developing them is quite another.

Most people recognise that something isn't working in their financial life, but they struggle to identify exactly what that is. Making matters more complex, our relationships with money, time, and self are deeply personal and often unconscious. They’re shaped by decades of experiences, family patterns, cultural messages, and past decisions.

This is where working with a fee-based holistic adviser becomes invaluable. Unlike commission-driven advisers who profit from selling products, fee-based advisers are compensated directly by you for their expertise and guidance. This alignment means their recommendations are driven by what's best for your situation, not what generates the highest commission.

A truly holistic approach recognises that your financial life doesn't exist in isolation from the rest of your life. Your money decisions affect your relationships, career choices, health, and overall life satisfaction. Similarly, changes in these other areas ripple back into your financial planning needs.

A skilled holistic adviser serves as both strategist and accountability partner. They help you identify any blind spots, challenge the assumptions limiting your progress, and keep you focused on what truly matters to you – rather than getting distracted by market noise or society's definition of success.

Perhaps most critically, they help you stay aligned with your true mission over time. Life evolves, priorities shift, and what felt right five years ago may no longer serve you today. Regular check-ins with an objective professional ensure your financial strategies continue reflecting your current values and goals, not outdated versions of yourself.

Professional Financial Advice Provides Value Beyond Returns

The investment in professional guidance pays dividends not just in financial returns, but in the peace of mind that comes from knowing your money, time, and life choices are all working in harmony towards what matters most to you.

There is no set-and-forget strategy when it comes to true financial wellness. Every day, week, month, quarter, and year, your plan must evolve and be reshaped to reflect the reality of your changing life. Just as your life is not set-and-forget—constantly growing, adapting, and responding to new circumstances—your financial strategy must be equally dynamic and responsive to serve you effectively.

Nick Stewart

(Ngāi Tahu, Ngāti Huirapa, Ngāti Māmoe, Ngāti Waitaha)

Financial Adviser and CEO at Stewart Group

Stewart Group is a Hawke's Bay and Wellington based CEFEX & BCorp certified financial planning and advisory firm providing personal fiduciary services, Wealth Management, Risk Insurance & KiwiSaver scheme solutions.

The information provided, or any opinions expressed in this article, are of a general nature only and should not be construed or relied on as a recommendation to invest in a financial product or class of financial products. You should seek financial advice specific to your circumstances from a Financial Adviser before making any financial decisions. A disclosure statement can be obtained free of charge by calling 0800 878 961 or visit our website, www.stewartgroup.co.nz

Article no. 424

References

¹ Kahneman, D., & Deaton, A. (2010). High income improves evaluation of life but not emotional well-being. Proceedings of the National Academy of Sciences, 107(38), 16489-16493.

² Thaler, R. H., & Sunstein, C. R. (2008). Nudge: Improving Decisions About Health, Wealth, and Happiness. Yale University Press.

³ Whillans, A. V., Dunn, E. W., Smeets, P., Bekkers, R., & Norton, M. I. (2017). Buying time promotes happiness. Proceedings of the National Academy of Sciences, 114(32), 8523-8527.

⁴ Kasser, T., & Ryan, R. M. (1996). Further examining the American dream: Differential correlates of intrinsic and extrinsic goals. Personality and Social Psychology Bulletin, 22(3), 280-287.

Why Holding Cash Feels Safe - But Isn't Always Wise

The ‘security’ of cash today often comes at the expense of tomorrow's purchasing power.

New Zealanders tend to hold cash reserves despite changing interest rate conditions. The RBNZ has cut the Official Cash Rate to 3.0% in August 2025 from its peak of 5.5% in early 2024, with term deposits following suit. While declining in line with the OCR, term deposit rates remain attractive; the highest rates on Canstar's database sit at 4.50%.

Yet, NZ’s economy contracted in the second quarter of 2025. Inflation increased to 2.70% in the same period[1] – well within the RBNZ's 1-3% target band but adding pressure to real returns.

The Money Illusion Trap

Many investors fall victim to what economists call "the money illusion": thinking about money in nominal rather than real terms[2].

A $100,000 term deposit earning 4.5% generates $4,500 annually, which feels like growth. But for someone paying 33% tax, the after-tax return is just $3,015 (3.015%). With inflation at 2.7%, this creates a real return of just 0.315%. For those in the top tax bracket (39%), this return becomes 2.745% - providing a microscopic real return of $45. That’s barely enough to buy a decent bottle of wine to drown your wealth preservation strategy sorrows.

Major bank economists forecast the OCR will fall to 2.5% by the end of 2025 or early 2026[3]. If term deposits drop to around 3%, a 33% taxpayer will earn an even measlier 2.01%.

Hidden Costs of Cash Comfort

Opportunity Cost: While current term deposits offer reasonable returns, historical equity market returns in New Zealand averaged 7-10% annually over longer periods. That 2-5% difference compounds substantially over decades.[4]

Rate Dependency Risk: With the two-year swap rate expected to drop to 2.8% as the OCR reaches 2.5%, retail deposit rates will follow. Unlike growth assets that can benefit from economic recovery, cash offers no upside participation.

Inflation Protection: Cash provides no hedge against rising costs. With administered prices driving near-term inflation pressures, purchasing power erosion remains a persistent threat.

The Economic Reality Check

New Zealand's economic recovery stalled in the second quarter. Spending is constrained by global economic policy uncertainty, falling employment, higher goods prices, and declining house prices. RBNZ notes there is scope to lower the OCR further if medium-term inflation pressures continue to ease as expected[5].

This makes holding large cash positions riskier; cash-savers face declining returns and miss potential recovery gains in other asset classes.[6]

Cash has its place – as part of a strategic, sophisticated portfolio, where professional advisers can implement a bond laddering strategy (providing income stability with superior yields to deposits), liquidity management to provide regular cash flow and reduce the need for large cash reserves and can recommend PIE funds and other tax-efficient structures that minimise the tax drag.

The Value of Professional Advice

History has shown many investors start panic selling during downturns, chasing performance at market peaks, or hoarding cash.

When cash returns are low, investors venture into adventurous territory: junk bonds, private credit, mezzanine debt arrangements, and other high-yield instruments that carry higher risks.

Working with a fee-only, fiduciary adviser is invaluable. Look for advisers who:

Conduct thorough discovery of your financial situation

Explain their investment philosophy and process clearly

Provide transparent fee disclosure with no hidden commissions

Demonstrate relevant credentials (CFP, AIF, CEFEX)

Show measurable progress tracking methods

The Bottom Line

With NZ’s economic headwinds, sitting in cash isn't the safe option - it's the wealth erosion option.

"She'll be right" doesn't cut the mustard when your money's losing value faster than a leaky boat. After tax and inflation, that "safe" term deposit is barely keeping you afloat. Your future wealth depends on making this distinction now, not when it's convenient.

Nick Stewart

(Ngāi Tahu, Ngāti Huirapa, Ngāti Māmoe, Ngāti Waitaha)

Financial Adviser and CEO at Stewart Group

Stewart Group is a Hawke's Bay and Wellington based CEFEX & BCorp certified financial planning and advisory firm providing personal fiduciary services, Wealth Management, Risk Insurance & KiwiSaver scheme solutions.

The information provided, or any opinions expressed in this article, are of a general nature only and should not be construed or relied on as a recommendation to invest in a financial product or class of financial products. You should seek financial advice specific to your circumstances from a Financial Adviser before making any financial decisions. A disclosure statement can be obtained free of charge by calling 0800 878 961 or visit our website, www.stewartgroup.co.nz

Article no. 423

References

Trading Economics. (2025). New Zealand Inflation Rate - Q2 2025. Available at: https://tradingeconomics.com/new-zealand/inflation-cpi

Shafir, E., Diamond, P., & Tversky, A. (1997). Money Illusion. Quarterly Journal of Economics, 112(2), 341-374.

ANZ Bank New Zealand. (2025). Weekly Data Wrap: Economic Forecasts and OCR Projections. Available at: https://www.anz.co.nz/about-us/economic-markets-research/data-wrap/

NZX Limited. (2024). Historical Returns Analysis: New Zealand Equity Market Performance 1987-2024. Wellington: NZX.

Reserve Bank of New Zealand. (2025). Monetary Policy Statement August 2025. Wellington: RBNZ. Available at: https://www.rbnz.govt.nz/hub/publications/monetary-policy-statement/2025/08/monetary-policy-statement-august-2025

DALBAR Inc. (2024). Quantitative Analysis of Investor Behavior: New Zealand Market Study. Boston: DALBAR Research.

Family Wealth and the Infamous 70% Rule

From Walmart to Toyota, some of the world's most successful businesses share a common thread – they're family-owned enterprises that have stood the test of time.

The Illusion of Time: A Wake-Up Call for High Achievers