Robert Burns believed wisdom belonged to everyone, not just the elite. Fast forward to today, and KiwiSaver reflects that same egalitarian spirit in finance. This article explores how Burns’ radical accessibility parallels the democratisation of investing in New Zealand. KiwiSaver isn’t just a savings scheme – it’s a structural shift that empowers every Kiwi to build wealth collectively. Discover why emotional intelligence and wise counsel matter as much as financial literacy.

The 12-Month Tax Gambit: Labour's Calculated Risk

Announcing a major tax policy a year before an election isn't just unusual; it's almost unheard of.

Conventional political wisdom dictates you either implement unpopular measures early in your term, or promise them after securing victory. Labour's decision to foreground a 28% capital gains tax ‘CGT’ a full year out from polling day demands examination, particularly through the lens of economist Arthur Laffer. His insight cuts straight through political calculation: speeding fines are a tax. Governments use taxes to stop people doing things they don't want them to do. So why would you tax investment when the country desperately needs more of it?¹

The timing becomes immediately suspect. Labour sits in opposition facing a National-led government, and historically, opposition parties campaign on aspiration rather than taxation. Helen Clark's 2005 Labour government actively campaigned against CGT proposals, recognising the electoral toxicity.² Yet here we are in late 2025, with Labour essentially writing National's attack ads 12 months in advance.

The Political Theatre

The political play is obvious: announce now, let the controversy "settle," and by election day the CGT feels like old news rather than shocking revelation. Labour hopes voters will be desensitised to what might otherwise be campaign-ending policy. It's political inoculation through extended exposure, with the policy carefully designed as "CGT light" (exempting family homes, farms, KiwiSaver and shares) to avoid the comprehensive wealth taxation that spooked voters in previous attempts.²

Yet as business commentator Damien Grant observes, the policy amounts to "a marketing plan sketched on the back of a napkin that had been used to wipe the lipstick off a chardonnay glass after drinks at a Fabian Society soiree."⁶ The policy amounts to a few pages in a glossy press release with less substance than a frozen coke.

If you own property in July 2027 and sell it after that date, you pay 28% of any increase in value, with no allowance for inflation. Family homes are exempt. That's essentially it—the rest is left to imagination and future consultation.

Recent polling shows Labour's framing is working – 43% support versus 36% opposition.² The 12-month runway allows this narrative to solidify. Labour bets that sustained messaging about "fairness" will ultimately land better than National's "tax on ambition" counter-narrative.

Laffer Curve | Source: Norway's Wealth Tax Unchains a Capital Exodus

The Fine Fallacy

Laffer's analogy cuts through the fluff. When government fines speeding, fewer people speed – that's the point. When government taxes cigarettes heavily, fewer people smoke – that's the objective. These are taxes deliberately designed to discourage the behaviour.

Applied to investment taxes, the logic is inescapable. When government taxes investment gains at 28%, fewer people invest. Yet that's meant to be revenue-neutral economic policy rather than deliberate discouragement? You cannot fine an activity and simultaneously expect more of it.

The contradiction becomes starker considering New Zealand's actual needs. Treasury warns that 52% of total tax comes from personal income tax, and the group paying this tax is shrinking due to an ageing population.⁴

The country desperately needs productive investment in commercial property, business expansion, and capital formation. Yet Labour proposes taxing precisely these activities, at rates designed to be punitive enough to raise revenue.

This is the economic equivalent of installing speed cameras on the motorway while simultaneously complaining that traffic isn't moving fast enough. You cannot discourage and encourage the same behaviour simultaneously.

The Implementation Damage

The July 2027 implementation date provides convenient political distance: win in November 2026, govern for eight months, then introduce legislation.²

But here's where political cleverness creates economic damage - the announcement effect begins immediately. Why would a developer start a commercial property project in 2026 knowing that any gains realised in 2028 or 2029 will face 28% taxation? Investment decisions from now until 2027 will be distorted by anticipated future taxes, locking capital out of productive uses or sending it offshore.³

The economic damage begins not when the tax takes effect, but when it's announced. We're living through that damage period now. The speeding camera has been installed, and the signs are up; don't be surprised when drivers slow down.

The British Warning

Laffer's analysis of Gordon Brown's decision to raise Britain's top rate from 40% to 50% provides the cautionary tale. The UK Treasury's own "Laffer section" showed the increase "not only did not get more revenue, it got you a lot less prosperity. People left the country, people used tax shelters, dodges, loopholes, all that."¹ As Laffer emphasised, this wasn't his opinion imposing American economics on Britain—"This was Britain doing the Laffer curve."¹

As Laffer notes from decades of US tax data: "Every time we've raised the highest tax rate on the top 1% of income earners, three things have happened. The economy has underperformed, tax revenues from the rich have gone down, and the poor have been hammered."¹

Conversely: "Every single time we've lowered tax rates on the rich, the economy has outperformed. Tax revenues from the rich have gone up and the poor have had opportunities to earn a living, to live a better life."¹

The Practical Nightmares

The practical problems compound the economic ones. Grant notes that inflation has already created havoc in Australia, where properties often can't be sold “because almost all of the price is considered a capital gain. This will be worse on the Hipkins plan because there is no indexation.”⁶

Consider a property bought in 2015 for $500,000 is now worth $800,000. Under Labour's plan, the entire $300,000 gain faces 28% taxation – that’s $84,000. But how much of that gain is real appreciation versus inflation? Without indexation, investors pay tax on phantom gains that merely reflect currency debasement.

Meanwhile, definitional nightmares await. Australia's capital gains tax guide runs to 339 pages, with court judgements adding hundreds more.⁶ Is replacing a kitchen a capital improvement or maintenance? What about landscaping? A 2028 Fisher and Paykel dishwasher replacing a 1980s Westinghouse: expense, or capital upgrade? As Grant notes drily: "Tax lawyers and accountants will be kept busy."⁶

The Chartered Accountants Institute supports Labour's proposal – hardly surprising, given it guarantees full employment for their profession dealing with compliance complexity.

The Fiscal Illusion

Even Chartered Accountants acknowledge that CGTs "do not generate significant revenue in the short or even medium terms. Long term, however, they typically provide a steady revenue stream… Using them to cover a specific policy expense is unusual."⁴ Yet Labour wants to use this non-existent revenue immediately to subsidise doctor visits.

As Grant observes: "There is a cash shortfall on Labour's own analysis in the early years which, like everything else in this policy, the resolution is left to the imagination."⁶ Here's the speeding fine logic again: if you install cameras to generate revenue from fines, you're simultaneously reducing the very behaviour that generates the revenue.

Successful speed cameras mean less speeding, and therefore less revenue. A capital gains tax that successfully deters property speculation means less property investment, and again, less revenue.

The Historical Pattern

This is Labour's seventh CGT attempt since 1973.² Norman Kirk's first attempt taxed gains at up to 90%, a rate so confiscatory it was quickly abandoned. Phil Goff's 2011 version, David Cunliffe's 2014 proposal, and Jacinda Ardern's 2019 attempt all failed politically.

Each previous effort proved politically costly and economically counterproductive. Voters instinctively understand Laffer's speeding fine logic, even if they can't articulate the economics by name. They recognise taxing investment reduces investment, just as fining speeding reduces speeding. Winston Churchill’s timeless observation perfectly captures the impossibility of taxing your way to prosperity – you cannot stand in a bucket and lift yourself up by the handles.⁵

The Alternative Vision

Laffer's prescription for struggling economies is brutally simple: "You want a low-rate, broad-based flat tax, spending restraint, sound money, minimal regulations, and free trade. And then get the hell out of the way."¹ Labour offers the opposite with new taxes on capital, sketchy implementation details, and revenue projections that don't add up.

As Laffer puts it: "Poor people don't work to pay taxes. They work to get what they can after tax. It's that very personal and very private incentive that motivates them to work, to quit one job and go to another job, to get the education they need to do it."¹ Replace "poor people" with "investors" and the logic remains - capital seeks returns. Tax those returns heavily enough, and capital goes elsewhere.

Perhaps most revealing: if this policy were genuinely beneficial for economic growth, why the elaborate political choreography? The answer lies in Laffer's observation about lottery tickets: "Everyone—tall, short, skinny, fat, old, young—they all want to be rich. Why does your government then turn around and tax the living hell out of the rich?"¹

New Zealanders don't want to punish success; they want pathways to achieve it themselves. They buy lottery tickets hoping to strike it rich. The government encourages dreams of wealth while simultaneously taxing the achievement of wealth.

The Verdict

The election will shortly reveal whether Labour's calculated 12-month strategy succeeds politically. By announcing early, they've given the policy time to settle, given themselves something concrete to campaign on, and satisfied membership demands for action on wealth taxation.

But both Laffer's economic analysis and Grant's practical critique suggest that regardless of electoral outcome, the policy itself represents strategic error. It's economic theory ignored in favour of political positioning.

New Zealand has better options. Genuine broadening of the tax base, reform of property taxation to encourage productive use, addressing infrastructure bottlenecks, and creating conditions for productivity growth would all contribute more to long-term prosperity than taxing capital gains at 28%. But those approaches require the hard work of reform rather than the easy politics of taxing "wealthy property investors."

Is Labour's CGT announcement politically canny, or economically catastrophic? When you deliberately discourage an activity through taxation, you can’t be surprised when you get less of it.

Labour has installed the camera; investment will slow accordingly. Whether that's clever politics or economic self-harm depends entirely on whether you're focused on winning the next election or building the next generation's prosperity.

As Laffer would note, you cannot tax an economy into prosperity. And you most certainly cannot stand in a bucket and lift yourself up by the handles.

Nick Stewart

(Ngāi Tahu, Ngāti Huirapa, Ngāti Māmoe, Ngāti Waitaha)

Financial Adviser and CEO at Stewart Group

Stewart Group is a Hawke's Bay and Wellington based CEFEX & BCorp certified financial planning and advisory firm providing personal fiduciary services, Wealth Management, Risk Insurance & KiwiSaver scheme solutions.

The information provided, or any opinions expressed in this article, are of a general nature only and should not be construed or relied on as a recommendation to invest in a financial product or class of financial products. You should seek financial advice specific to your circumstances from a Financial Adviser before making any financial decisions. A disclosure statement can be obtained free of charge by calling 0800 878 961 or visit our website, www.stewartgroup.co.nz

Article no. 433

References

Simmons, M. (2024). Reality Check: Interview with Arthur Laffer. Times Radio.

Opes Partners (2025). 'Does New Zealand Have a Capital Gains Tax? [2025]'. Available at: https://www.opespartners.co.nz/tax/capital-gains-tax-nz

RNZ (2025). 'What you need to know: Seven questions about a capital gains tax'. Available at: https://www.rnz.co.nz/news/business/577065/what-you-need-to-know-seven-questions-about-a-capital-gains-tax

Chartered Accountants Australia and New Zealand (2025). 'Capital gains tax must be considered as part of tax reform'.

Churchill, W.S. (1906). For Free Trade. London: Arthur Humphreys.

Grant, D. (2025). 'Hipkins' capital gains tax policy leaves more questions than answers'. Stuff. Available at: https://www.stuff.co.nz/politics/360878756/damien-grant-hipkins-capital-gains-tax-policy-leaves-more-questions-answers

When Ideology Replaces Analysis: The Sparrow Lesson for Investors

It's fairly well known that Mao Zedong's Great Leap Forward (1958–1962) ended in one of history's deadliest famines: tens of millions died, villages emptied by hunger, fields stripped bare. What's less well known is how a war on sparrows helped set the catastrophe in motion. [1]

‘Ed Brown’ by Michael Parekowhai, 2000 - A favourite of Nick’s that hangs on the wall at home.

In 1958, Mao launched the Four Pests Campaign, targeting rats, flies, mosquitoes… and sparrows. The tiny birds, he decreed, were "enemies of the people" for daring to eat the people's grain. [2]

And so, an entire civilisation mobilised against the feathered menace. Schoolchildren banged pots and pans in the streets, peasants drummed on washbasins, and factory sirens screamed for hours to keep the birds in flight until they fell dead from exhaustion. Nests were torn down, eggs smashed, and chicks stomped into the earth.

The results were biblical. In Beijing alone, more than a million sparrows were killed in a matter of weeks. Rural communes competed to see who could pile the highest mountain of avian corpses, a kind of grotesque festival of progress.

But victory, when it came, was short-lived. The sparrows, it turned out, had been eating more insects than grain. Within a year, the skies were empty, and the earth was crawling. Locusts rose like living clouds, devouring fields from horizon to horizon. Peasants watched in horror as the crops disappeared into the mandibles of an unstoppable plague of their own making.

Rather than admit his mistake, Mao doubled down on absurdities. He replaced the sparrows with imported Soviet "science" – the theories of Trofim Lysenko, an agronomist who believed that crops could be re-educated through hard labour. Genetics was bourgeois nonsense, Lysenko said; what mattered was enthusiasm. If you ploughed deeper, planted closer, and shouted revolutionary slogans loudly enough, the harvest would multiply.

So, fields were churned to depths that eviscerated the biome, seedlings were planted shoulder to shoulder until none could breathe, and bureaucrats inflated yields to impossible heights. Mountains of fake grain were reported; much of the real grain was exported to show socialist success.

By 1960, China was starving. Whole provinces were dying in silence. Still, the propaganda blared: "The people's communes are good!"

A survivor later put it simply: "We killed the birds, and then the insects ate everything else."

New Zealand's Sacred Cow

We have our own version of Lysenko's ideology. You've heard it at every barbecue, every family gathering, every pub conversation about money:

"You can't go wrong with bricks and mortar."

"Buy land – God's not making any more of it."

"Rent money is dead money."

"Safe as houses."

"Property always goes up."

For two decades, these mantras proved prophetic. House prices in Auckland rose 500% between 2000 and 2021. Kiwi households saw their home become their retirement plan, their children's inheritance, their ticket to prosperity. Property investment became a religion, complete with its own prophets (real estate agents), its own evangelists (property coaches), and its own scripture (Rich Dad Poor Dad).

The scriptures were simple: leverage to the hilt, buy multiple rentals, negative gear against your income, and watch the capital gains roll in. Interest rates were at historic lows (and surely they'd stay there forever). The government needed house prices to keep rising; from pensioners to banks, the entire economy seemed to float on residential property values.

Alas - ideology, no matter how many believers it has, eventually meets mathematical reality.

When the Locusts Arrived

When the Reserve Bank lifted the Official Cash Rate from 0.25% to 5.5% between 2021 and 2023, the proverbial locusts began to swarm and feast. [3]

Investors who'd stretched to buy rental properties on interest-only loans at 2.5% suddenly faced repayments double what they'd planned for. Those who'd bought at the peak in 2021, with the assumption that prices would continue relentlessly marching upward, now watched their equity disappear into the maw of change.

The median house price in New Zealand has fallen 18% from its 2021 peak according to CoreLogic, with steeper declines in some regions. In Wellington, prices dropped over 20%. [5], [4]

Investors who bought at the top, banking on endless capital gains to compensate for negative cash flow, are now holding properties worth less than their mortgages. Negative equity isn't just an American problem from the 2008 crisis anymore; it's arrived in Epsom and Island Bay, in Christchurch and Hamilton. [5]

Mortgage stress has become a daily reality for thousands of New Zealand families. What was affordable at 2.5% is crushing at 7%. Property gambles that made sense when you could lock in cheap debt for years, now bleed money every month.

The Property Value Fundamentals We Ignored

Like Mao's bureaucrats ignoring the ecology of pest control, New Zealand ignored the fundamentals that underpin property values:

1. Debt serviceability

We convinced ourselves record-low interest rates were the new normal; a pleasantly permanent feature of the economic landscape.

They weren't. They were weather, not climate.

Anyone who'd stress-tested their mortgage at 7% rates had a good idea what this would look like, but most didn't bother. After all, the Reserve Bank had signalled rates would stay low until 2024, hadn't they? (They had. They were wrong.)

2. Yield vs. cost

Rental properties returning 3% gross yield while mortgages cost 7% represents what economist Hyman Minsky termed "Ponzi finance"—where income flows cover neither principal nor interest charges, requiring continuous new debt or capital appreciation to survive [6]. When prices stopped rising, the mathematics became unavoidable. You can't lose money every month and call it investing just because you hope the asset will appreciate.

3. Supply and demand

Yes, God's not making more land. But man is making more zoning laws, more construction, and more high-density housing. Auckland's recent upzoning has added the potential for tens of thousands of new dwellings. National's push for urban intensification is changing the supply equation.

Supply does respond to price eventually. The assumption that demand would endlessly outstrip supply was ideology, not analysis.

4. Demographic and economic shifts

Net migration swings wildly:

We saw massive outflows to Australia when its economy boomed.

Birth rates are falling.

Working from home changed where people want to live, making provincial cities more attractive.

How to Avoid Being the Sparrow Killer

No investment is exempt from fundamental analysis – not even the quarter-acre Kiwi dream. Here’s what you need to do:

Test your assumptions first

Before buying property (or any investment), ask the hard questions: Can I afford this if interest rates hit 8%? What if the property stays vacant for three months? What if it needs a $30,000 roof replacement? What if prices don't rise for a decade—can I still hold on? If your investment only works under best-case scenarios, you're not investing—you're gambling with borrowed money.

Recognise ideology masquerading as wisdom

When someone says "you can't go wrong with property”: ask them about Japan, where house prices fell for fifteen consecutive years after 1991 with Tokyo property losing 60% of its value. Or Ireland, where property crashed 50% in 2008-2012. Or Detroit, where homes now sell for less than second-hand cars. [6]

The phrase "you can't go wrong" is the most dangerous in investing. You absolutely can go wrong with property, shares, bonds, or any other asset – when you pay too much, borrow too heavily, or ignore the fundamentals.

Understand that all assets are priced relative to alternatives

When term deposits paid 0.5%, property's 3% gross yield looked attractive by comparison. At 5.5% risk-free rates from the bank, suddenly that leveraged rental property earning 3% gross (maybe 1% after rates, insurance, maintenance, and management) looks substantially less clever. Capital always flows to its best risk-adjusted return. When safe returns become attractive again, risky assets must reprice.

Seek Wise Counsel

Honest, professional financial advice isn’t just valuable in these situations; it’s essential.

Not the mate at the barbecue repeating what worked in 2015. Not the property spruiker selling $5,000 weekend seminars on wealth creation. Not the Instagram influencer with a Lamborghini, a course to sell, and a P.O. box in the Cayman Islands.

Find an adviser who'll tell you hard truths instead of comfortable lies. Someone who'll stress-test your assumptions, challenge your thinking, and ask the questions you don’t want to acknowledge:

What if you're wrong?

What if rates stay high for five years?

What if prices don't recover for a decade?

What does your portfolio look like if this happens?

The best financial advice often sounds boring. That’s because it is boring: it involves diversification across asset classes, appropriate leverage you can service in bad times, understanding what you own and why, and planning for scenarios you hope won't happen.

It's not a catchy slogan you can repeat at a dinner party. It's certainly not exciting enough to build a social media following around.

Instead, it's mathematics, discipline, humility, and the wisdom to know that "everyone's doing it" has never – not once in the history of markets – been a sound investment strategy. Quite the opposite; when everyone's doing it, that’s usually a good moment to step back and ask why.

Mao surrounded himself with yes-men who told him what he wanted to hear. The sparrows paid the price. Then the insects thrived. Then the people paid the price. The echo chamber produced catastrophe because ideology replaced observation, and enthusiasm replaced analysis.

The Bottom Line for Kiwi Investors

Don't let your financial future be decided by mantras. Don't let social ‘proof’ substitute for due diligence. And crucially, don't assume what has worked for the past twenty years will work for the next twenty.

Instead, seek counsel that respects the complexity of markets, acknowledges uncertainty honestly, understands risk as well as reward, and helps you build wealth on foundations stronger than popular sentiment or revolutionary enthusiasm.

The fundamentals always win. Always. The only question is whether you'll be positioned to weather the fallout, or whether you’ll be left exposed in the fields.

The locusts are always waiting.

Nick Stewart

(Ngāi Tahu, Ngāti Huirapa, Ngāti Māmoe, Ngāti Waitaha)

Financial Adviser and CEO at Stewart Group

Stewart Group is a Hawke's Bay and Wellington based CEFEX & BCorp certified financial planning and advisory firm providing personal fiduciary services, Wealth Management, Risk Insurance & KiwiSaver scheme solutions.

The information provided, or any opinions expressed in this article, are of a general nature only and should not be construed or relied on as a recommendation to invest in a financial product or class of financial products. You should seek financial advice specific to your circumstances from a Financial Adviser before making any financial decisions. A disclosure statement can be obtained free of charge by calling 0800 878 961 or visit our website, www.stewartgroup.co.nz

Article no. 432

References

[1] F. Dikötter, *Mao's Great Famine: The History of China's Most Devastating Catastrophe, 1958–-1962*.. London: Bloomsbury Publishing, 2010.

[2] J. Shapiro, *Mao's War Against Nature: Politics and the Environment in Revolutionary China*.. Cambridge: Cambridge University Press, 2001.

[3] Reserve Bank of New Zealand, “Official Cash Rate decisions and historical data,”, 2024. [Online]. Available: https://www.rbnz.govt.nz

[4] Real Estate Institute of New Zealand (REINZ), “Historical house price data and market statistics,”, 2024. [Online]. Available: https://www.reinz.co.nz

[5] CoreLogic New Zealand, “House price indices and market analysis reports,”, 2024. [Online]. Available: https://www.corelogic.co.nz

[6] H. P. Minsky, “The Financial Instability Hypothesis,”, The Jerome Levy Economics Institute Working Paper No. 74, 1992.

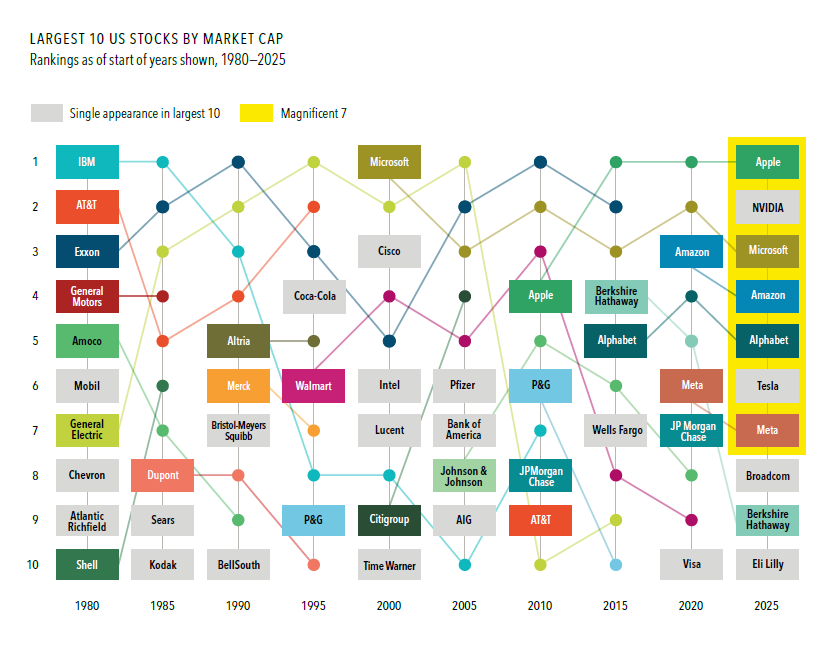

The Magnificent 7: Why Yesterday’s Winners May Not Be Tomorrow’s Champions

Financial advisers are facing intense pressure from clients: should portfolios be loaded up on the Magnificent 7 stocks (Apple, Microsoft, Amazon, Alphabet, Meta, NVIDIA, and Tesla)?

These tech giants have delivered spectacular returns and now dominate America’s largest companies. Clients’ friends are bragging about gains, financial media breathlessly covers every earnings report, and the fear of missing out is palpable.

But financial lessons tell us to look beyond the headlines and recent performance – and market history suggests this caution is warranted.

The Illusion of Permanence

When we look at today’s market leaders, it’s easy to assume they’ll remain on top indefinitely. These companies have massive cash reserves, dominant market positions, and appear to be shaping our technological future. But market history tells a different story.

Consider this statistic from Dimensional Fund Advisers’ analysis: of the 10 largest US companies in 1980, only three made it to the top 10 by 2000.[1] Even more striking, none of those 1980 giants appears in today’s top 10. Companies like IBM, AT&T, and Exxon – once considered unassailable titans – have been replaced by an entirely new generation of market leaders.

This is more than trivia; it’s a fundamental lesson about impermanent market dynamics that should inform every portfolio decision.

Research from the Centre for Research in Security Prices demonstrates that market leadership is far more transient than most investors realise: In 1980, six of the 10 largest companies were energy firms.[1] Today, technology dominates. This wasn’t gradual. It was a wholesale transformation driven by innovation and shifting economic fundamentals.

This pattern should concern anyone betting that today’s technology concentration will last for decades. Seemingly unstoppable industries may face disruption from sources we cannot yet imagine.

Technological advancement doesn’t benefit only technology companies. Throughout history, firms across all industries have leveraged new technologies to innovate and grow. The internet didn’t just create wealth for internet companies; it transformed retail, finance, healthcare, and virtually every sector.

Similarly, McKinsey research suggests AI adoption could add trillions in value across all economic sectors, not just technology.[2] A pharmaceutical company using AI for drug discovery or a manufacturer deploying advanced robotics may deliver returns that rival pure-play tech stocks – anything is possible at this stage.

The Case for Diversification

Modern Portfolio Theory, developed by Nobel laureate Harry Markowitz, demonstrates that diversification is the only “free lunch” in investing – it reduces risk without necessarily sacrificing returns.[3]

Diversification doesn’t mean avoiding the Magnificent 7 per se. These companies earn their market positions through genuine competitive advantages. It does mean resisting the temptation to overweight them simply because they’ve performed well recently. A diversified portfolio allows participation in current market leaders while maintaining exposure to companies and sectors that may emerge as tomorrow’s giants.

Remember, many of today’s Magnificent 7 were relatively small or didn’t exist 25 years ago. The next generation of market leaders is likely being built right now.

Working with a financial adviser can help you recognise and combat recency bias – this is the tendency to assume recent trends will continue indefinitely. Behavioural finance research shows this cognitive bias often leads to poor investment decisions.[4] And as any adviser worth their salt will be able to tell you, the Magnificent 7’s impressive performance creates a psychological pull to buy more of these stocks – but this often means buying high and taking concentrated risk precisely when valuations are stretched.

Instead of chasing performance, you need to stay focused on your long-term goals. Maintaining discipline around portfolio construction through regular rebalancing forces you to trim any areas that have grown over-large, so you (or rather, your financial adviser) can redeploy capital to areas that may offer better prospective returns.[5]

The Path Forward

Market history doesn’t repeat itself, but it often rhymes. While predicting which companies will lead markets in 2040 or 2050 is impossible, the leaders of the pack will certainly change. New technologies, business models, and companies will emerge, and the current leaders may become footnotes in global markets history.

A globally diversified portfolio positions you to benefit from these changes, rather than being hurt by them. They participate in today’s success stories while remaining open to tomorrow’s opportunities.

The Magnificent 7 have earned their place among America’s largest companies through innovation and execution. But despite how tempting they are, the best course of action isn’t to chase yesterday’s winners or follow the herd – it’s to build resilient portfolios that serve your unique needs.

Building a plan that can weather change (while capturing opportunity wherever it emerges) requires diversification, discipline, and a healthy respect for the lessons of market history. If that sounds daunting, try arranging a chat with your local, fiduciary financial adviser to discuss what your first steps might be – it’s a better use of your time than tracking Magnificent 7 performance, anyway.

Nick Stewart

(Ngāi Tahu, Ngāti Huirapa, Ngāti Māmoe, Ngāti Waitaha)

Financial Adviser and CEO at Stewart Group

Stewart Group is a Hawke's Bay and Wellington based CEFEX & BCorp certified financial planning and advisory firm providing personal fiduciary services, Wealth Management, Risk Insurance & KiwiSaver scheme solutions.

The information provided, or any opinions expressed in this article, are of a general nature only and should not be construed or relied on as a recommendation to invest in a financial product or class of financial products. You should seek financial advice specific to your circumstances from a Financial Adviser before making any financial decisions. A disclosure statement can be obtained free of charge by calling 0800 878 961 or visit our website, www.stewartgroup.co.nz

Article no. 429

References

Dimensional Fund Advisers. (2024). “Will the Magnificent 7 Stay on Top?” *Dimensional Quick Take*, using data from the Centre for Research in Security Prices (CRSP) and Compustat, University of Chicago.

McKinsey Global Institute. (2023). “The Economic Potential of Generative AI: The Next Productivity Frontier.” McKinsey & Company.

Markowitz, H. (1952). “Portfolio Selection.” *The Journal of Finance*, 7(1), 77-91.

Kahneman, D., & Tversky, A. (1979). “Prospect Theory: An Analysis of Decision under Risk.” *Econometrica*, 47(2), 263-291.

Buetow, G. W., Sellers, R., Trotter, D., Hunt, E., & Whipple Jr, W. A. (2002). “The Benefits of Rebalancing.” *Journal of Portfolio Management*, 28(2), 23-32.

When Geniuses Get Burned: A Timely Lesson on Bubbles, Diversification, and the Perils of FOMO

On a crisp morning stroll through Edinburgh recently, whilst following my son’s rugby team in the UK, I found myself at the Scottish National Gallery of Modern Art, where Eduardo Paolozzi’s 1989 statue of Sir Isaac Newton caught my eye. Cast in bronze with geometric fragments, Newton is depicted as the “Master of the Universe,” his head bowed intently over mathematical instruments. It’s a mesmerising tribute to one of history’s greatest intellects, immortalised in deep contemplation of the cosmos.

But statues don’t tell the full story. What Paolozzi’s work omits is Newton’s humiliating financial debacle during the South Sea Bubble of 1720-a cautionary tale that resonates profoundly in today’s volatile markets. Historical accounts reveal that Newton initially invested a modest sum in South Sea Company stock, cashed out with a respectable profit, then watched enviously as his friends amassed fortunes while prices skyrocketed. Succumbing to the fear of missing out (FOMO), he re-entered the market near its peak with a much larger stake [1]. When the bubble inevitably burst, Newton lost approximately £ 20,000, equivalent to about £6 million today (adjusted for inflation), or roughly $14 million in New Zealand dollars [2]. His wry reflection afterwards? “I can calculate the motions of heavenly bodies, but not the madness of people” [3].

This episode isn’t just an amusing footnote in the life of a scientific giant; it’s a stark reminder that even the sharpest minds are vulnerable to market mania. If Newton, the architect of calculus and gravity, couldn’t outsmart the crowd, what hope do everyday investors have in navigating today’s hype-driven landscapes, like the AI boom?

Unpacking the Bubble Phenomenon

Financial bubbles are seductive traps, identifiable only after they’ve popped. They thrive on compelling narratives that mask underlying risks. In 1720, the South Sea Company’s promise of exclusive trade rights with South America fuelled wild speculation, driving stock prices from around £100 to over £1,000 in months before collapsing [4]. Closer to home, New Zealand’s 1987 sharemarket crash serves as a vivid parallel: fuelled by deregulation and easy credit, the NZSE index surged, only to plummet 60% in weeks, wiping out leveraged fortunes in property and equities [5, 11]. The aftermath was brutal: bankruptcies, shattered families, and a lingering distrust of markets that scarred a generation.

More recently, Auckland’s property market exhibited bubble characteristics, with median house prices tripling between 2011 and 2021 amid low interest rates and high demand [6]. These episodes highlight a pattern: euphoria driven by “this time it’s different” optimism, followed by inevitable reversion to fundamentals.

Enter today’s hottest debate: artificial intelligence. Is AI the next fire, wheel, or microchip-a paradigm shift revolutionising healthcare, agriculture, and beyond? Or is it overhyped, with valuations echoing the dotcom bubble, where slapping “.com” on a business sent stocks soaring regardless of viability [7]? Companies like Nvidia have seen shares rocket over 100% in the past year on AI enthusiasm, but sceptics warn of irrational exuberance. The truth? No one knows for sure. AI could deliver transformative value, or it might follow the path of past tech fads, leaving late entrants holding the bag.

Why Diversification is Your Best Defence

In the face of such uncertainty, diversification emerges not as a conservative cop-out, but as a strategic imperative. When predicting individual winners is near-impossible, the smart play is to spread your bets across the market. Own a broad index fund, and let capitalism’s machinery-competition, innovation, and resource allocation-work its magic over the long haul.

Strolling Edinburgh’s Royal Mile, I paused at the statue of Adam Smith, the Scottish economist whose 1776 masterpiece, The Wealth of Nations, introduced the “invisible hand” [8]. Smith argued that self-interested individuals, through free markets, inadvertently create societal benefits by directing capital to its most productive uses. No top-down planning required-just the aggregate wisdom of millions of decisions fostering efficiency and growth.

This evolutionary aspect of capitalism is key: viable companies flourish, while hype-driven ones wither. Yet spotting them in advance is a fool’s errand. Studies show that even seasoned fund managers underperform broad market indices over time, with survivorship bias and fees eroding returns [9]. For individual investors chasing the next Amazon or dodging the next Enron, the odds are stacked even higher against success.

New Zealanders have ample tools for diversification: local or global index funds covering thousands of companies, often accessible via platforms like KiwiSaver. These vehicles ensure you participate in growth sectors like AI without overexposure. Miss the ground-floor entry on Nvidia? No problem-a diversified portfolio still captures the upside while shielding you from sector-specific crashes.

The Psychology of Smart People Making Dumb Moves

Newton’s misadventure underscores a timeless truth: raw intelligence offers no immunity to behavioural biases. As Daniel Kahneman explains in Thinking, Fast and Slow, our brains are wired for quick, intuitive decisions that often lead us astray in complex environments [10]. Newton fell victim to a classic cycle: initial caution (fear of loss), sidelined envy (FOMO), and impulsive greed fuelled by social proof from his peers.

This dynamic played out vividly in New Zealand’s 1987 crash. Professionals-doctors, lawyers, accountants-piled into “can’t-lose” investments with borrowed money, convinced by the herd that prices would rise forever. When reality hit, the rapid 60% drop erased wealth overnight, triggering a cascade of personal and economic fallout [11].

Human nature hasn’t evolved since Newton’s day. Greed, fear, and herd mentality persist, amplified by social media and 24/7 news cycles. In the AI era, viral success stories can lure even savvy investors into concentrated bets, ignoring the risks.

Building Resilience Through Diversification

While diversification won’t eliminate downturns (markets are volatile by nature), it mitigates ruinous losses. Imagine holding only South Sea stock: total devastation. But a basket of British equities? Painful, but survivable, with recovery potential. The MSCI World Index’s ~8% average annual gross return over 30 years, weathering multiple crashes, exemplifies this resilience [9].

Apply this to AI: if it revolutionises society, diversified holders benefit via broad tech exposure. If it fizzles, your portfolio’s other sectors (healthcare, consumer goods, energy) provide ballast [12]. The key is discipline: resist the siren call of hot tips and maintain a balanced allocation.

Final Reflections: Wisdom from the Past

Gazing at Newton’s statue, the irony hit me: a monument to unparalleled genius, yet its subject was felled by the same primal instincts that plague us all. Bubbles will recur because human psychology is immutable. But we can arm ourselves with humility, acknowledging our limitations in outguessing markets.

Embrace diversification as your anchor, harnessing capitalism’s long-term compounding power. You don’t need Newton-level brilliance to thrive financially-often, recognising your non-genius status is the cleverest strategy.

And don’t go it alone. Newton might have avoided disaster with impartial advice. A trusted financial adviser won’t forecast the next bubble but will enforce discipline: reminding you that past performance doesn’t predict future results, crowds are often wrong, and capital preservation trumps speculative gains. They’ll tailor a diversified plan to your goals, helping you navigate emotional turbulence and emerge stronger.

In an unpredictable world, this approach turns potential pitfalls into opportunities. Review your portfolio today: is it diversified enough to withstand the next mania? If not, seek wise counsel-it could be the difference between exiting happy and exiting broke.

Nick Stewart

(Ngāi Tahu, Ngāti Huirapa, Ngāti Māmoe, Ngāti Waitaha)

Financial Adviser and CEO at Stewart Group

Stewart Group is a Hawke's Bay and Wellington based CEFEX & BCorp certified financial planning and advisory firm providing personal fiduciary services, Wealth Management, Risk Insurance & KiwiSaver scheme solutions.

The information provided, or any opinions expressed in this article, are of a general nature only and should not be construed or relied on as a recommendation to invest in a financial product or class of financial products. You should seek financial advice specific to your circumstances from a Financial Adviser before making any financial decisions. A disclosure statement can be obtained free of charge by calling 0800 878 961 or visit our website, www.stewartgroup.co.nz

Article no. 428

References

Odlyzko, A. (2018). Notes and Records: The Royal Society Journal of the History of Science, 73(1), 29-59.

UK Office for National Statistics Composite Price Index; Bank of England inflation calculator (1750-2025).

Levenson, T. (2009). Newton and the Counterfeiter. Houghton Mifflin Harcourt.

Dale, R., et al. (2005). The Economic History Review, 58(2), 233-271.

Easton, B. (1997). In Stormy Seas. Otago University Press.

Reserve Bank of New Zealand Housing Data Series (2011-2021).

Shiller, R. J. (2015). Irrational Exuberance (3rd ed.). Princeton University Press.

Smith, A. (1776). Wealth of Nations. W. Strahan and T. Cadell, London.

Malkiel, B. G. (2019). A Random Walk Down Wall Street (12th ed.). W. W. Norton & Company.

Kahneman, D. (2011). Thinking, Fast and Slow. Farrar, Straus and Giroux.

Steeman, M. (2017). Stuff.co.nz, 19 October 2017.

Bogle, J. C. (2017). The Little Book of Common Sense Investing (10th Anniversary ed.). John Wiley & Sons.

The 300: Staying Strong in Uncertain Times

300 can have all kinds of meanings. It’s the number of articles we’ve just hit in this column, for example – a great cricket innings. Mathematically, it’s the sum of 2 prime numbers and also of 10 consecutive prime numbers. It’s also famously the number of Spartans who, against all odds, held back the masses of the invading Persian army for two days in the Battle of Thermopylae.