Financial advisers are facing intense pressure from clients: should portfolios be loaded up on the Magnificent 7 stocks (Apple, Microsoft, Amazon, Alphabet, Meta, NVIDIA, and Tesla)?

These tech giants have delivered spectacular returns and now dominate America’s largest companies. Clients’ friends are bragging about gains, financial media breathlessly covers every earnings report, and the fear of missing out is palpable.

But financial lessons tell us to look beyond the headlines and recent performance – and market history suggests this caution is warranted.

The Illusion of Permanence

When we look at today’s market leaders, it’s easy to assume they’ll remain on top indefinitely. These companies have massive cash reserves, dominant market positions, and appear to be shaping our technological future. But market history tells a different story.

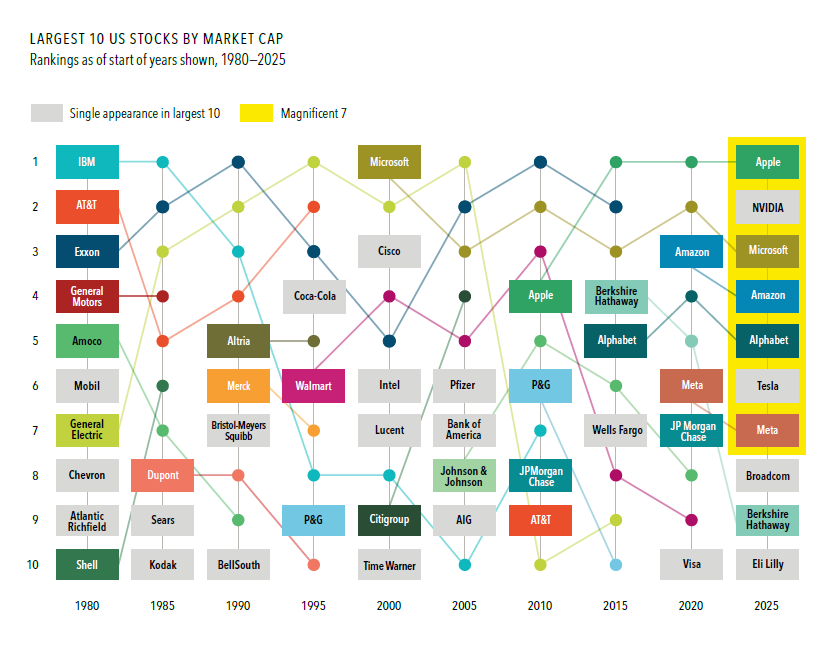

Consider this statistic from Dimensional Fund Advisers’ analysis: of the 10 largest US companies in 1980, only three made it to the top 10 by 2000.[1] Even more striking, none of those 1980 giants appears in today’s top 10. Companies like IBM, AT&T, and Exxon – once considered unassailable titans – have been replaced by an entirely new generation of market leaders.

This is more than trivia; it’s a fundamental lesson about impermanent market dynamics that should inform every portfolio decision.

Research from the Centre for Research in Security Prices demonstrates that market leadership is far more transient than most investors realise: In 1980, six of the 10 largest companies were energy firms.[1] Today, technology dominates. This wasn’t gradual. It was a wholesale transformation driven by innovation and shifting economic fundamentals.

This pattern should concern anyone betting that today’s technology concentration will last for decades. Seemingly unstoppable industries may face disruption from sources we cannot yet imagine.

Technological advancement doesn’t benefit only technology companies. Throughout history, firms across all industries have leveraged new technologies to innovate and grow. The internet didn’t just create wealth for internet companies; it transformed retail, finance, healthcare, and virtually every sector.

Similarly, McKinsey research suggests AI adoption could add trillions in value across all economic sectors, not just technology.[2] A pharmaceutical company using AI for drug discovery or a manufacturer deploying advanced robotics may deliver returns that rival pure-play tech stocks – anything is possible at this stage.

The Case for Diversification

Modern Portfolio Theory, developed by Nobel laureate Harry Markowitz, demonstrates that diversification is the only “free lunch” in investing – it reduces risk without necessarily sacrificing returns.[3]

Diversification doesn’t mean avoiding the Magnificent 7 per se. These companies earn their market positions through genuine competitive advantages. It does mean resisting the temptation to overweight them simply because they’ve performed well recently. A diversified portfolio allows participation in current market leaders while maintaining exposure to companies and sectors that may emerge as tomorrow’s giants.

Remember, many of today’s Magnificent 7 were relatively small or didn’t exist 25 years ago. The next generation of market leaders is likely being built right now.

Working with a financial adviser can help you recognise and combat recency bias – this is the tendency to assume recent trends will continue indefinitely. Behavioural finance research shows this cognitive bias often leads to poor investment decisions.[4] And as any adviser worth their salt will be able to tell you, the Magnificent 7’s impressive performance creates a psychological pull to buy more of these stocks – but this often means buying high and taking concentrated risk precisely when valuations are stretched.

Instead of chasing performance, you need to stay focused on your long-term goals. Maintaining discipline around portfolio construction through regular rebalancing forces you to trim any areas that have grown over-large, so you (or rather, your financial adviser) can redeploy capital to areas that may offer better prospective returns.[5]

The Path Forward

Market history doesn’t repeat itself, but it often rhymes. While predicting which companies will lead markets in 2040 or 2050 is impossible, the leaders of the pack will certainly change. New technologies, business models, and companies will emerge, and the current leaders may become footnotes in global markets history.

A globally diversified portfolio positions you to benefit from these changes, rather than being hurt by them. They participate in today’s success stories while remaining open to tomorrow’s opportunities.

The Magnificent 7 have earned their place among America’s largest companies through innovation and execution. But despite how tempting they are, the best course of action isn’t to chase yesterday’s winners or follow the herd – it’s to build resilient portfolios that serve your unique needs.

Building a plan that can weather change (while capturing opportunity wherever it emerges) requires diversification, discipline, and a healthy respect for the lessons of market history. If that sounds daunting, try arranging a chat with your local, fiduciary financial adviser to discuss what your first steps might be – it’s a better use of your time than tracking Magnificent 7 performance, anyway.

Nick Stewart

(Ngāi Tahu, Ngāti Huirapa, Ngāti Māmoe, Ngāti Waitaha)

Financial Adviser and CEO at Stewart Group

Stewart Group is a Hawke's Bay and Wellington based CEFEX & BCorp certified financial planning and advisory firm providing personal fiduciary services, Wealth Management, Risk Insurance & KiwiSaver scheme solutions.

The information provided, or any opinions expressed in this article, are of a general nature only and should not be construed or relied on as a recommendation to invest in a financial product or class of financial products. You should seek financial advice specific to your circumstances from a Financial Adviser before making any financial decisions. A disclosure statement can be obtained free of charge by calling 0800 878 961 or visit our website, www.stewartgroup.co.nz

Article no. 429

References

Dimensional Fund Advisers. (2024). “Will the Magnificent 7 Stay on Top?” *Dimensional Quick Take*, using data from the Centre for Research in Security Prices (CRSP) and Compustat, University of Chicago.

McKinsey Global Institute. (2023). “The Economic Potential of Generative AI: The Next Productivity Frontier.” McKinsey & Company.

Markowitz, H. (1952). “Portfolio Selection.” *The Journal of Finance*, 7(1), 77-91.

Kahneman, D., & Tversky, A. (1979). “Prospect Theory: An Analysis of Decision under Risk.” *Econometrica*, 47(2), 263-291.

Buetow, G. W., Sellers, R., Trotter, D., Hunt, E., & Whipple Jr, W. A. (2002). “The Benefits of Rebalancing.” *Journal of Portfolio Management*, 28(2), 23-32.