Robert Burns believed wisdom belonged to everyone, not just the elite. Fast forward to today, and KiwiSaver reflects that same egalitarian spirit in finance. This article explores how Burns’ radical accessibility parallels the democratisation of investing in New Zealand. KiwiSaver isn’t just a savings scheme – it’s a structural shift that empowers every Kiwi to build wealth collectively. Discover why emotional intelligence and wise counsel matter as much as financial literacy.

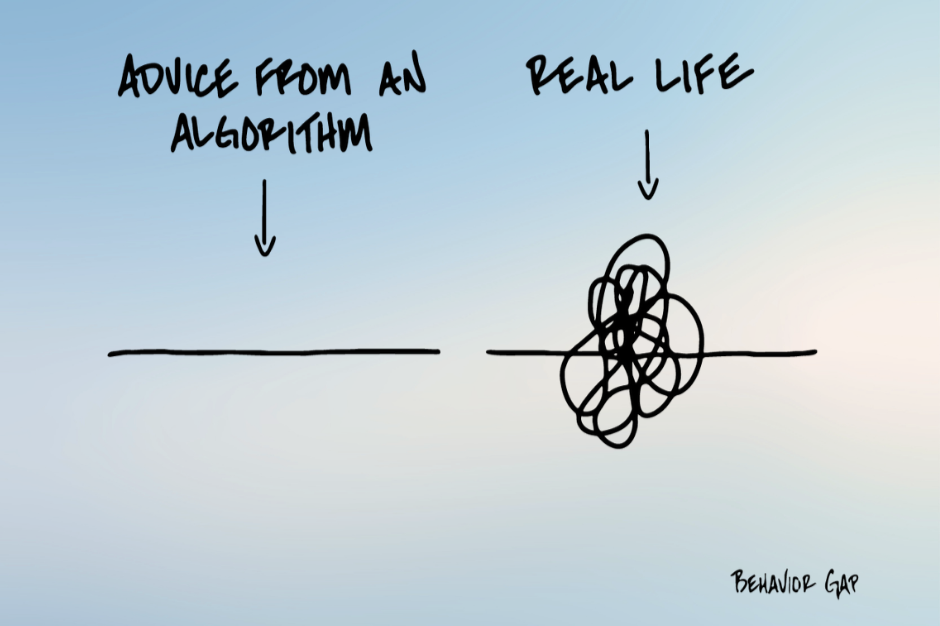

Taking Advice from Algorithms: Why the Messy Line Matters

You know what real life looks like? Messy. But you wouldn't know it from most financial plans – not algorithmic ones, anyway.

Most advice out there comes as a straight line. A tidy formula. Clean inputs, clean outputs. Do X, get Y! Save this percentage, retire at that age. Follow these steps, achieve this outcome.

But real life is messier. It's a chaotic tangle of loops and knots and unexpected detours.

And here's the thing about that mess—it's not a bug. It's not a sign you're doing it wrong. It's not evidence that you're bad with money or that you lack discipline. The mess is the point. The mess is what makes us human.

The Seduction of the Straight Line

There's something deeply appealing about algorithmic advice. It’s so clean. Plug in your numbers, and out comes a plan: no ambiguity, no second-guessing. Just follow the formula.

When you're overwhelmed by financial decisions, a straight line feels like relief. Someone—or something—finally has the answer. “Just tell me what to do, and I'll do it!”

Everything’s mapped out. It’s paint by numbers, just like when you were a kid.

But here's what the algorithm doesn't know: it doesn't know that your mother just got diagnosed with cancer and you're trying to figure out if you can afford to take unpaid leave. It doesn't know that your child is struggling in school and needs a tutor you hadn't budgeted for. It doesn't know that you just got an unexpected bonus and you're torn between paying down debt, investing, or finally taking that trip you've been postponing for five years.

The algorithm doesn't know that you're human, and life changes.

Why Math Isn't Enough

Don’t be mistaken - the maths matters. Of course it does! Compound interest is real. Time value of money is real. The difference between a 6% return and an 8% return over thirty years is very real.

But when we reduce money to maths alone, we forget what it feels like to make decisions when you're scared. Or uncertain. Or grieving. Or excited. Or exhausted. Or newly in love. Or watching your industry collapse. Or getting a second chance you never expected.

Financial decisions aren't made in a vacuum. They're made in the tangled middle of actual lives.

That's why human financial advice still matters. Not because humans are better at maths than machines—we're definitely not. But because good advisors know that the maths is just the beginning. The real work is helping people navigate the gap between what the spreadsheet says they should do and what feels possible in their actual circumstances.

Algorithms Optimise, Humans Navigate

Here's what I've learned after years of working with people and their money: algorithms optimise for efficiency. Humans navigate complexity.

An algorithm can tell you the mathematically optimal move. But it can't tell you whether that move is worth the fight it'll cause with your spouse. It can't weigh the emotional cost of saying no to your child’s sports travel team against the financial benefit of staying on track. It can't factor in the value of sleeping soundly at night, even if that means choosing a less "optimal" investment.

There's a reason Japanese retirement homes started removing robots and bringing back human caregivers.1 The robots were more efficient. They didn't get tired. They didn't call in sick. They could lift residents without risking back injuries. But the residents wanted the human touch. They wanted someone who could sense when they needed comfort, not just assistance. Someone who could respond to mood, not just medication schedules.

The same principle applies to money. The algorithm gives you the straight line. The human advisor helps you draw your actual path through the tangled mess.

And sometimes the best financial decision isn't the one that maximizes your net worth. Sometimes it's the one that lets you live with yourself. Sometimes it's the one that honours your values, even when it costs you. Sometimes it's the one that acknowledges you're not just a rational economic agent making optimal choices—you're a person trying to build a life that matters.

You Don't Know Where You Sit on the Curve

Late last year, I wrote about how no one actually knows where they sit on the curve of life's probabilities.2 The algorithm assumes average. But you're not living an average life—you're living your specific life, with your specific luck (good and bad) in any given year. My claims year proved that perfectly.

Some years, you sail through with nothing but routine expenses. The algorithm would call that "optimal."

Other years, everything hits at once. Three family emergencies, a job loss, a health scare, and a busted gearbox. The algorithm would call that "suboptimal" or "poor planning."

Yet, both years are just… life. You didn't do anything wrong in the hard year. You didn't do anything especially right in the easy year. You just lived as normal, where probability meets reality and the straight line becomes a scribble.

The Question Worth Asking

So here's what I want you to ask someone you care about today: What did your budget not account for this past year?

Budgets are great. I believe in them. But they're not magic. Real life always sneaks something in. The car repair. The friend's wedding at the other end of the country. The opportunity you couldn't pass up. The emergency that wasn't really an emergency but felt like one at the time.

Those deviations from the plan? They're not failures. They're data. They're information about what your life actually requires, not what the algorithm thinks it should require.

The straight line is beautiful. But the tangled mess is real. And real is where we have to learn to make good decisions.

Why We Still Seek Human Advice

Here's the deeper truth about why people still seek human financial advice in an age of robo-advisors and AI-powered planning tools: life is dynamic, and our responses need to be too.

A good financial plan isn't static. It breathes. It adapts. It changes when your circumstances change, when your values shift, when unexpected opportunities arise or unwanted challenges appear.

The algorithm updates when you feed it new numbers. The human advisor updates when they see the worry in your eyes, hear the excitement in your voice, sense the hesitation you can't quite articulate. They adjust not just to what has changed, but to how you've changed.

Because here's what the tangled mess really represents: not chaos, but adaptation. Not failure, but responsiveness. Not a deviation from the plan, but evidence that you're paying attention to your actual life and adjusting accordingly.

The straight line assumes the future will be like the past. The tangled line knows better. It knows that life zigs when you expect it to zag. It knows that the best plan is one that can bend without breaking, that can accommodate both disaster and delight, that can hold space for the full complexity of being human.

That's not a bug in the system. That's the whole point of having a life worth planning for.

Nick Stewart

(Ngāi Tahu, Ngāti Huirapa, Ngāti Māmoe, Ngāti Waitaha)

Financial Adviser and CEO at Stewart Group

Stewart Group is a Hawke's Bay and Wellington based CEFEX & BCorp certified financial planning and advisory firm providing personal fiduciary services, Wealth Management, Risk Insurance & KiwiSaver scheme solutions.

The information provided, or any opinions expressed in this article, are of a general nature only and should not be construed or relied on as a recommendation to invest in a financial product or class of financial products. You should seek financial advice specific to your circumstances from a Financial Adviser before making any financial decisions. A disclosure statement can be obtained free of charge by calling 0800 878 961 or visit our website, www.stewartgroup.co.nz

Article no. 440

References

James Wright's research on Japanese eldercare facilities found that care workers often rejected robots like the "Hug" lifting device, preferring to care with their own hands and finding it more respectful to residents. See: Wright, James. Robots Won't Save Japan: An Ethnography of Eldercare Automation (Cornell University Press, 2023); and MIT Technology Review's coverage of robot implementation challenges in Japanese care homes (January 2023). ↩

"Why Self-Insurance Rarely Works," Stewart Group, December 5, 2024 ↩

When Good Intentions Meet Poor Planning

A successful professional – let's call him "Mr H" – had built an impressive career and accumulated substantial wealth. He owned property, had invested in overseas estates, and maintained generous pension arrangements.

He also had a complex personal life: an estranged wife he still supported financially, a long-term partner who had borne his only child, and extended family who depended on him.

Before embarking on what would prove to be his final business venture, Mr H added a hasty codicil (an addition) to his existing will. In it, he praised his partner's invaluable contributions to his career and pleaded that she be given "an ample provision to maintain her rank in life."¹ He entrusted her and their young daughter as "a legacy to my company and extended family," confidently expecting that his colleagues and family would honour his wishes.

He was catastrophically wrong.

The Background: A Man at the Height of Success

Mr H had reached the pinnacle of his profession. He was celebrated, wealthy, and influential. He purchased a substantial country estate – a property with elegant gardens, spacious grounds, and all the trappings of success. He paid approximately $2.25 million for the initial property and would eventually expand his holdings to over 160 acres, spending another $2 million on additional land purchases, creating what he called his "paradise."

His partner, Miss E, was instrumental in transforming the property, which featured five spacious bedrooms, two large drawing rooms, a dining room, library, extensive grounds with ornamental gardens, and even an icehouse. Mr H was so delighted with the estate that he repeatedly expanded it, despite his own written advice to Miss E not to acquire anything "too large, for the establishment of a large household would be ruinous."

And oh, the irony of those prophetic words…

The Will: A Masterclass in What Not to Do

Despite his professional acumen and access to the best legal minds of his era, Mr H's estate plan was fundamentally flawed. His original will left his entire estate, including lucrative overseas investments generating substantial annual income, to his brother Mr W (a clergyman). To his partner Miss E, he left only the substantial home and gardens, as well as a modest $125,000 annual income from his overseas estate. His daughter Miss H received $1m for education and a $50,000 allowance annually.²

On paper, these seemed like reasonable provisions. In reality, they were a recipe for disaster.

The problems were immediate and devastating:

Failure #1: No Trust Structure

Despite trusts being well-established legal instruments at the time, Mr H left everything to Mr W outright, apparently assuming his brother would "do the right thing" and support Miss E and Miss H. Family loyalty, after all, should count for something. He didn't even put his wishes in writing within the will itself. He just relied on an understanding between brothers.

He was wrong. Mr W and his wife immediately distanced themselves from Miss E—conveniently forgetting that she had cared for their own children for years while they pursued their own interests, and kept every penny.³ Given Mr H's dangerous profession and rather unique home life situation, a trust would have worked particularly well to protect his vulnerable dependents. A trust would have ensured regular payments to Miss E, protected Miss H's inheritance until she came of age, and prevented Mr W from simply pocketing everything.

But Mr H chose personal trust over legal structure. This was a mistake.

Failure #2: Gifting Encumbered Assets

The substantial home and gardens had been Mr H's pride and joy, his "paradise" where he could finally relax between his demanding work commitments. The property required constant maintenance, employed numerous servants, and demanded significant annual upkeep costs that far exceeded the modest $125,000 annual income Miss E received.²

The estate became an albatross around her neck. She couldn't afford to maintain it properly, yet she couldn't bear to sell her only tangible connection to the man she loved. She was asset-rich but cash-poor, a predicament that would lead to her financial ruin. Had Mr H consulted with estate planning professionals, they would have immediately identified this mismatch between the asset's carrying costs and the income provided to support it.

The property needed either sufficient income to maintain it, or it should have been sold with the proceeds placed in trust for Miss E's benefit. Instead, he gave her an expensive liability disguised as an asset.

Failure #3: Relying on Third Parties

The codicil added just before his final business venture was emotional rather than legally binding. Mr H "hoped" and "trusted" that his business associates would provide for Miss E, citing her work and contributions to the company's success.¹ He wrote movingly about her service and sacrifice, expecting that gratitude and honour would compel them to act.

But hope isn't a legally enforceable instrument. When his business chose to ignore his dying wishes, there was no mechanism to compel them. They threw a lavish $3.5 million funeral celebrating his achievements but didn't spend a penny on his partner or child.² Miss E approached them repeatedly, armed with Mr H's codicil and the testimony of colleagues who had witnessed his wishes. They refused every time.

Had these provisions been written into a binding legal agreement or trust structure, Miss E would have had recourse. Instead, she had only Mr H's heartfelt words… which proved worthless in court.

Failure #4: No Contingency Planning

What if his business refused to honour his wishes? What if Mr W proved ungenerous? What if Miss E fell into debt due to the property's crushing costs? What if she died while Miss H was still a minor; who would protect the child then?

None of these scenarios were addressed. Mr H had made his fortune through strategic planning in his professional life, carefully considering risks and preparing for multiple contingencies. Yet he left his personal affairs almost entirely to chance, apparently believing that good intentions and family loyalty would be sufficient.

The Devastating Aftermath

Miss E tried desperately to maintain the substantial home and gardens as a memorial, entertaining influential contacts in hopes of securing the support Mr H had promised would come. She invested what little money she had into keeping up appearances, hoping that someone – Mr W, the business associates, influential friends – would finally help.

Instead, she fell deeply into debt. With no legal protection and no reliable income, creditors closed in.⁴ The very property that was supposed to provide her with security became her prison. Within just eight years of Mr H's death, she was arrested for debt. She and young Miss H fled the country, living in poverty overseas – a shocking fall for a woman who had once been celebrated in the highest circles of society.

Miss E died in squalor around Miss H's fourteenth birthday, denying to the end that she was the girl's mother – perhaps hoping to spare her daughter the stigma of illegitimacy that would have made her life even harder.⁵ Miss H had to be smuggled back home disguised as a boy to avoid arrest for her mother's debts.⁶ The daughter returned home penniless, her childhood shattered, to be passed between reluctant relatives who viewed her as an unwanted burden.

Meanwhile, Mr W received a $25 million grant to purchase an estate, along with prestigious titles for himself and his son; the very honours Mr H had aspired to but never achieved in life. Other family members received $2.5 million each.² Even Mr H's estranged wife, from whom he had been separated for years, received generous provision.⁷

Everyone was taken care of, except the woman and child he loved most.

From the Northern Club Art Collection

Title: Portrait of Lord Nelson

Artist: Benjamin West

The Reveal

The saga above isn't hypothetical, nor is it contemporary. This catastrophic failure of estate planning happened over 200 years ago. "Mr H" is Vice-Admiral Horatio Nelson, 1st Viscount Nelson: the most celebrated naval commander in British history, victor of Trafalgar, the man whose column still dominates London's Trafalgar Square. "Miss E" is Emma, Lady Hamilton, "Miss H" is their daughter Horatia, and "Mr W" is his brother, the Reverend William Nelson.

Merton Place, the estate Nelson loved so dearly, was eventually sold off in pieces. Today, the site where Britain's greatest naval hero found his "paradise" is occupied by modern housing estates and a pub called The Nelson Arms. Not a single brick remains of the house where he spent his happiest days.

If someone of Nelson's intelligence, status, and access to legal counsel could make such devastating mistakes, what hope do the rest of us have without proper planning?

6 Lessons for Today’s Investors

The lessons from this 200-year-old tragedy remain relevant today:

1. Use trusts for complex situations. Don't rely on family members to "do the right thing." Create legally binding structures that ensure your wishes are carried out regardless of personal relationships or good intentions.

2. Match assets to beneficiaries' actual needs. Don't gift property or assets that require more income than you're providing to maintain them. Consider the total cost of ownership, not just the asset's value.

3. Make provisions legally enforceable. Emotional appeals and dying wishes carry no legal weight. If you want something done, make it a binding legal obligation, not a heartfelt request.

4. Plan for contingencies. What if your primary plan fails? What if beneficiaries predecease you? What if relationships change? Good estate planning anticipates multiple scenarios.

5. Don't let complex personal situations discourage proper planning. If anything, unusual family arrangements demand MORE sophisticated planning, not less. Nelson's situation (an estranged wife, a partner, an illegitimate child, and complex family dynamics) required expert legal structures, not informal arrangements.

6. Review and update regularly. Nelson's codicil was added hastily before battle. Professional estate planning requires time, thought, and regular review as circumstances change.

200 years later, Nelson's strategic brilliance at Trafalgar is remembered and celebrated. But so is the tragedy of Emma Hamilton and Horatia Nelson, abandoned to poverty and disgrace despite his dying wishes:

“Take care of my dear Lady Hamilton, Hardy. Take care of poor Lady Hamilton.”⁸

He tried. But without proper legal structure and financial planning, good intentions meant nothing.

Nick Stewart

(Ngāi Tahu, Ngāti Huirapa, Ngāti Māmoe, Ngāti Waitaha)

Financial Adviser and CEO at Stewart Group

Stewart Group is a Hawke's Bay and Wellington based CEFEX & BCorp certified financial planning and advisory firm providing personal fiduciary services, Wealth Management, Risk Insurance & KiwiSaver scheme solutions.

The information provided, or any opinions expressed in this article, are of a general nature only and should not be construed or relied on as a recommendation to invest in a financial product or class of financial products. You should seek financial advice specific to your circumstances from a Financial Adviser before making any financial decisions. A disclosure statement can be obtained free of charge by calling 0800 878 961 or visit our website, www.stewartgroup.co.nz

Article no. 439

References

Encyclopedia.com. "Hamilton, Emma (1765–1815)." Women in World History: A Biographical Encyclopedia. Available at: https://www.encyclopedia.com/women/encyclopedias-almanacs-transcripts-and-maps/hamilton-emma-1765-1815

Wikipedia. "Emma, Lady Hamilton." Accessed November 2025. Available at: https://en.wikipedia.org/wiki/Emma,_Lady_Hamilton

Lady Hamilton & Horatio Nelson. "Nelson's Inheritance (part 50)." Words Music and Stories, January 7, 2023. Available at: https://wordsmusicandstories.wordpress.com/2023/01/07/lady-hamilton-horatio-nelson-nelsons-inheritance-part-50/

Wikipedia. "Horatia Nelson." Accessed November 2025. Available at: https://en.wikipedia.org/wiki/Horatia_Nelson

National Museum of the Royal Navy. "The extraordinary life of Horatia Nelson." Available at: https://www.nmrn.org.uk/news/extraordinary-life-horatia-nelson

Find a Grave. "Horatia Nelson Ward (1801-1881)." Available at: https://www.findagrave.com/memorial/6884289/horatia-ward

Lilystyle. "Nelson's Descendants in Brent." Available at: https://lilystyle.co.uk/nelson-s-descendants-in-brent.html

Goode, Tom and Dominic Sandbrook. "RIHC | Nelson EXTRA: The Fate of Lady Hamilton." The Rest Is History podcast, November 5, 2025. Available at: https://podcasts.apple.com/nz/podcast/the-rest-is-history/id1537788786

Merton Historical Society. "A History of Lord Nelson's Merton Place." Available at: https://mertonhistoricalsociety.org.uk/a-history-of-lord-nelsons-merton-place/

Warwick, Peter. "Here was paradise - A description of Merton Place." Available at: https://wandle.org/aboutus/nelson2005/paradise.htm

Note: Historical currency amounts (pounds sterling, circa 1805) have been converted to approximate modern dollar equivalents, accounting for inflation and purchasing power.