Earlier in March, David Clark announced the Government’s intent to make changes to the CCCFA following immediate and widespread backlash – the review coming just two months after it was implemented.

So has anything much changed, or are people still in limbo?

As a nation obsessed with home ownership, the sharp increase in hurdles between your average first home buyer and the coveted quarter-acre has left many floundering. Higher interest rates, higher prices, low stock, and a series of legislative changes have acted as a barrier to all but a lucky few.

The already-infamous CCCFA was implemented in December 2021 with the view to stop predatory lending practices. It went a bit further than that, and banks were refusing to take chances when there was a $200,000 personal fine for anyone found at fault. Lending, unsurprisingly, slowed right down in the lead-up and after implementation.

Complaints on the restrictive nature of the CCCFA came thick and fast from both financial institutions and the people the Act was meant to protect, who needed a beyond-squeaky-clean three month expenses record to even get a look in.

Hence – the review. And the two-stage fix, which is set to be finalised and implemented by June.

The changes include removing regular savings and investments from would-be borrowers expenses that were measured against their intended loan.' This is a great start as it means people won’t be punished for responsible savings habits.

They also took away the need for lenders to comb meticulously through bank statements of all borrowers – an apparent reference to some of the more notorious items which have been reportedly added to people’s outgoings. We can only hope this means a latte is not literally going to break the bank anymore for would-be borrowers.[i]

The Minister is staying staunch to the CCCFA not being at fault for reduced lending, despite claims from would-be borrowers and those in the industry. He points instead to a combination of factors like increases to the OCR, LVR changes and an increase in house prices and local government rates.[ii] Which, yes, do contribute to the slow down we’ve all heard about recently – but the original and extremely restrictive wording of the Act didn’t exactly lend itself (pardon the pun) to solving the issue.

Image: REINZ

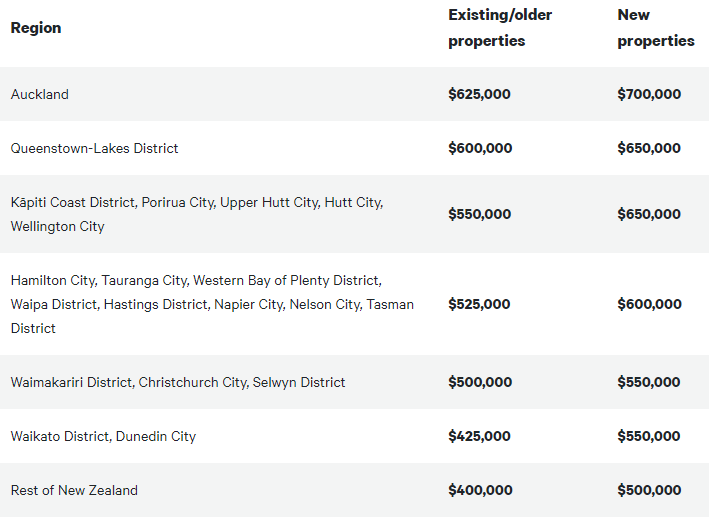

However this plays out by June, there’ll be some who still slip through the cracks. The pricing in most NZ regions is well over the cap Kāinga Ora will fund as part of their first home initiative, so those needing help with a deposit may not be able to access it.

Here in Hawke’s Bay, REINZ reports our February median house price was $812,000.[iii] The cap for the Kāinga Ora first home grant in Hastings District or Napier City is $525,000 for existing properties or $600,000 for new properties (land to build on).

If you were hoping to pick up something cheaper and DIY it with the classic No.8 wire mentality, you’re out of luck. The guidelines also stipulate the house must be habitable from settlement date. If you’re buying land, the land must be “ready to build on”, or the cost of getting it ready must be included under the cap.[iv]

Image: Kāinga Ora

What about an apartment, which tends to be cheaper and would fall under that cap?

We can thank past disasters like the Sirocco Apartments for the banks’ reluctance to lend for apartments. You need a 50% deposit in most cases now, as banks are less likely to take the risk given how poorly some complexes were built in the not-so-distant past (and the subsequent losses of those who bought into them).

You may remember Sirocco Apartments as having leak issues in 23 out of 44 apartments, which were downplayed to prospective buyers. One resident claims to have spent almost $500k on top of the $397k he paid to purchase the apartment, just in repairs for leak issues. The body corporate secretary was found liable for breaching the Fair Trade Act, but was not assigned damages.[v]

There’s a deficit of homes suitable for first home buyers – affordable, liveable and bank friendly. So even if you manage to get through both raising the deposit and getting approved for a mortgage, you may find the pool of properties within budget is more of a murky puddle.

If you have a deposit and you’re not seeing much action with either a loan or the home itself, you may just have to hold tight. If your deposit is coming from your KiwiSaver fund, now’s a good time to check if you’re in the right kind of fund for a short-term goal – as opposed to saving for retirement, where more time means you could handle more risk if you are comfortable doing so.

In the meantime, don’t give up on any good savings habits just because home ownership seems out of reach. There’s merit to staying the course; more money down the track is always going to be a good thing. And if your goals change or you decide to rethink your timeframe, you could always look into other ways to invest your money.

An easy place to start getting your financial house in order is to call a trusted fiduciary to discuss your current situation and goals.

· Nick Stewart is a Financial Adviser and CEO at Stewart Group, a Hawke's Bay-based CEFEX certified financial planning and advisory firm. Stewart Group provides personal fiduciary services, Wealth Management, Risk Insurance & KiwiSaver solutions.

· The information provided, or any opinions expressed in this article, are of a general nature only and should not be construed or relied on as a recommendation to invest in a financial product or class of financial products. You should seek financial advice specific to your circumstances from an Authorised Financial Adviser before making any financial decisions. A disclosure statement can be obtained free of charge by calling 0800 878 961 or visit our website, www.stewartgroup.co.nz

[i] https://www.goodreturns.co.nz/article/976520030/cccfa-changes-need-to-go-further-bankers-association.html

[ii] https://www.beehive.govt.nz/release/govt-updates-responsible-lending-rules

[iii] https://www.reinz.co.nz/residential-property-data-gallery

[iv] https://kaingaora.govt.nz/home-ownership/first-home-grant/check-property-criteria/

[v] https://www.stuff.co.nz/business/property/111579609/wellington-body-corporate-manager-downplayed-sirocco-apartments-leak-issues